Energy Cable: The oil market is OVERLY pessimistic by now..

Take aways:

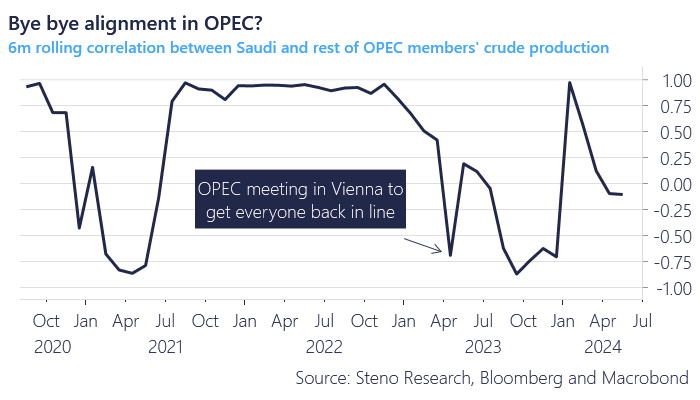

- Alignment in OPEC is crumbling but the short-term risk-reward is STRONG

- Riyadh Accord coming to the rescue?

- Natural Gas markets remain tight and the bullish price action CONTINUE

- Another week of increasing freight rates

OPEC’s cohesion is becoming increasingly fragile due to the necessity for deep supply cuts to sustain oil prices. Saudi Arabia is shouldering the bulk of these cuts, as many other member countries are reluctant to reassess their production baselines. This uneven distribution of cutbacks underscores the vulnerabilities and internal disagreements within OPEC. Saudi Arabia’s significant role highlights both its influence and the challenges the organization faces in maintaining unity and effectively managing production levels.

At the latest OPEC meeting, traders and market watchers were most surprised by the announcement from the eight states implementing the 2.2 million barrels per day (b/d) of voluntary cuts. These states declared they would begin unwinding these cuts after the third quarter of this year. The plan involves a gradual return of supply starting in October 2024 and extending through September 2025. Supply increments will be around 180,000 b/d each month during the fourth quarter of 2024 and approximately 200,000 b/d each month from January to September 2025.

We typically see a short-term increase in cohesion after the first disappointment after an OPEC meeting, which leaves a decent risk/reward in being long short-term. Medium-term, it is the demand side that must now take the driver’s seat in bringing oil prices higher, as the supply side seems rather “locked.”

Chart 1.a: OPEC.. Dead man walking?

The positioning is very negative in energy markets, which looks like a decent contrarian signal to us. We continue to like energy (both oil and Nat Gas) versus metals into July.

0 Comments