Energy Cable: OPEC needs a big rebound on the demand side

Evening from Europe!

What a bloodbath in long oil bets today, and we are bleeding alongside the crowd as we are down 5.7% in our long bets in the CLN4 future.

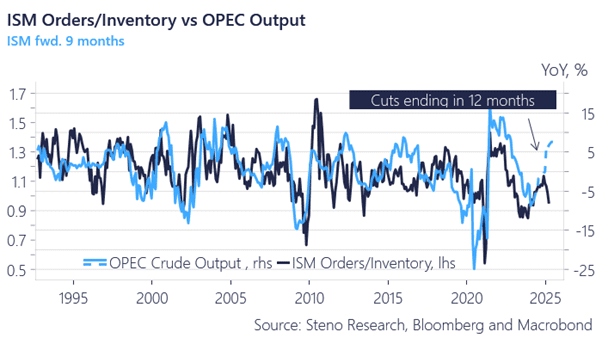

The OPEC+ meeting over the weekend did not fuel a bullish supply narrative as we can (at best) expect the status quo. The supply cuts were prolonged (as was our base-case), but assuming that the cuts will actually be reversed by June or September 2025, which seems to be the forward guidance from OPEC now, we’d have to see a much stronger business cycle in Manufacturing for that to match with the demand side.

We do also note that the OPEC+ production is procyclical empirically (see chart 1), so an increase in the production is actually a sign of improving demand trends rather than the opposite. The OPEC group is betting on a cyclical upswing into 2025, which we currently concur with, but the demand side will have to do the heavy lifting for oil bulls, not the supply side.

Chart 1: The business cycle needs to rebound for OPEC to be right

The OPEC group continues to keep the supply of oil artificially low, but the big question is now the demand side of the equation. This OPEC policy is bullish, if the demand side keeps improving.

0 Comments