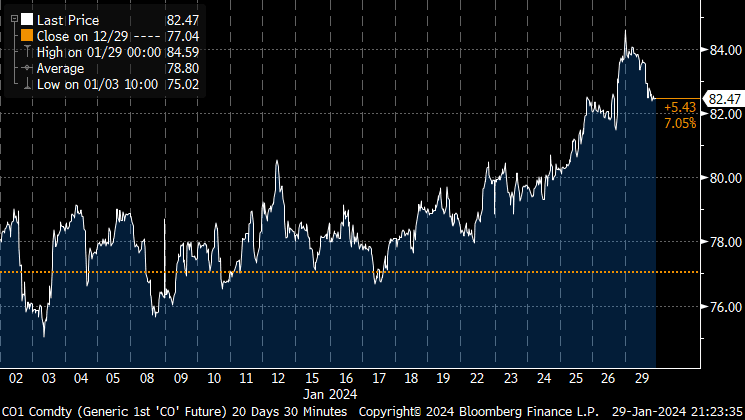

Energy Cable #55: Red Sea troubles leading to breakout in oil!

Last week we wrote “For crude oil, the Houthis still let VLCC through the Suez hence crude’s range bound trading between 75-80 USD throughout Jan even amidst all the troubles. Watch out for crude to break above USD 80 on the back of rising inflation expectations in the US” and it only took three days for both US economic strength and a Houthis attack on an oil tanker to drive CO1 above USD 80.

According to Javier Blas, the Houthis fired a missile at a tanker operated by Trafigura setting the tanker on fire, which the crew was able to extinguish. The big caveat here is that Trafigura was transporting Russian oil. Up until this point there had been a steady frequency of Dirty VLCC at the Suez throughout 2023 and into the new year. If this changes, then brace yourself..

The Houthis’ attack on a crude tanker isn’t the only cause for concern for energy bears since Ukraine have begun targeting Russian gas/crude terminals, which is another clear upside risk for price action in energy space.

For more on the risk in geopolitics, we encourage you to listen to our latest Macro Sunday podcast on the topic.

Chart 1.a: Ladies and gentlemen, I believe this is what we call a break out

The Red Sea crisis contagion is spreading to the energy space. With signs of stress emerging in Energy Markets, we have entered a timely long as positioning remains light despite the ongoing Red Sea debacles.

0 Comments