Energy Cable #51: Tensions increasing fast in the Red Sea

Happy New Year everybody and welcome to this year’s first edition of the Energy Cable.

Crude oil prices started rallying into and over the Christmas holiday period with focus on the Houthis’ attacks on vessels in the Red Sea which prompted us to have a look at the numbers.

The developments over the weekend have increased tensions, and we are eagerly awaiting the initial price action of the year to see how nervous the market is. Iran has now entered the frame after the US Navy killed several piracy Houthis on Sunday.

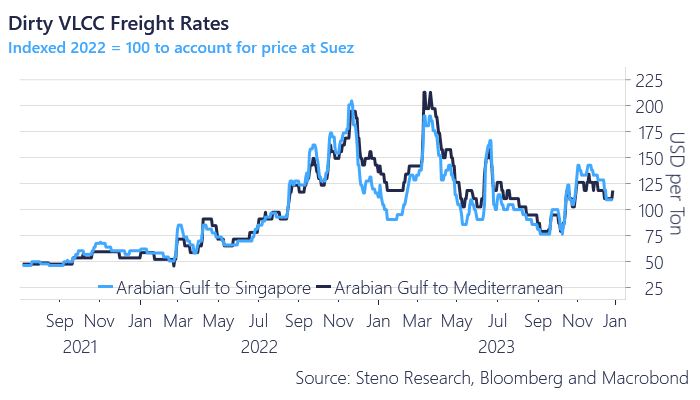

We’ll start by having a look at the price action in the Red Sea where freight rates of seaborne crude ships going from the Gulf towards the Mediterranean Sea via the Suez Canal haven’t moved materially, but there are signs of Dirty Suezmax prices diverging materially depending on the geographical route (see chart 1.b). This is the chart to watch the coming days and weeks.

Clearly the story hasn’t been overly worrying for market prices yet, but that is very much helped by the low demand in Europe making trips through the Red Sea less necessary and EUR/USD trading higher through Dec. LNG is a great example of this. Currently 0 ships are transiting the Suez canal and ordinarily that would be cause for concern given how fragile European gas markets are currently, but when temperatures are (and have been for weeks) above mean and stock levels above 90% then markets are shrugging it off for now.

The situation remains very vulnerable though, especially when paired with evidence of the apparent rerouting of ships in the paragraph below.

Chart 1.a: An uptick in the Suez Premium

Tensions are clearly on the rise in the Red Sea with fatal stand-offs over the New Years weekend. The most recent satellite photo evidence suggests that supply chain disruptions are material but manageable. Will the Houthis propel energy- and transportation costs again?

0 Comments