Energy Cable #44 – Energy as a diversifier + JPY focus

Your weekly Energy Cable with thoughts on the growing correlations across natural gas and electricity in Europe and a quick JPY take

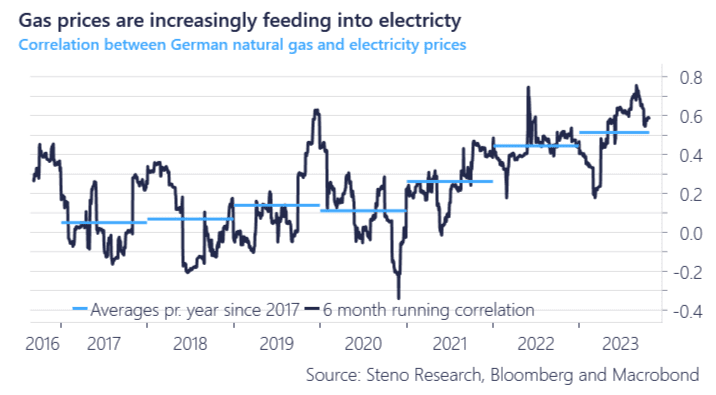

This week an interesting development in the correlation between electricity prices and natural prices caught our attention as seen in the below chart. Over the last 3 years we have seen the correlation between the two move higher and higher to a point where electricity prices are almost a mirrored reflection of what is going on in the gas markets.

We have two key takeaways from this chart:

- Volatility in natural gas markets mean volatility in the energy component of the European inflation basket which leaves the Europeans with two options. Diversification of energy mix (Ahem, nuclear) and/or less electricity consumption meaning less wealth (If you believe that consumption has found a new equilibrium post price spikes)

- More fragility in the European energy systems. With the high reliance on natural gas, topics like French nuclear electricity production or Rhein levels will have an even larger impact.

Chart 1: Electricity and natural gas correlation moving higher and higher

Your weekly Energy Cable with thoughts on the growing correlations across natural gas and electricity in Europe and a quick JPY take

0 Comments