EIA Watch: Strong Energy demand month in October, except in Nat Gas

Welcome to our inaugural EIA Watch.

Every Thursday, we will assess the demand side of the energy equation via our sophisticated seasonally adjusted models based on the weekly EIA time series.

Conclusions up front:

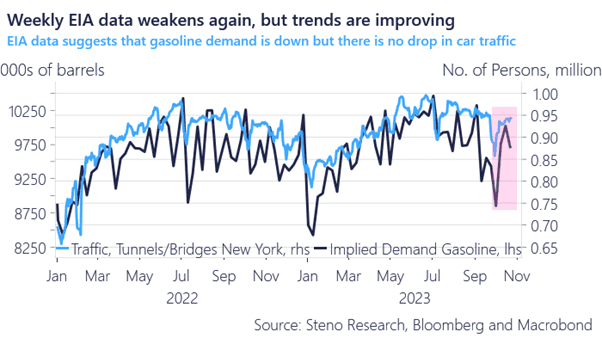

– EIA fuel data remains weaker than suggested by actual congestion on roads, in ports and in the air. We expect a further recovery in the EIA data (seasonally adjusted) in November.

– The Gasoline demand rebounded more than 1mn barrels a day in October compared to the abysmal September data.

– Diesel demand is up around 300k barrels a day in October and is back in a steady range despite high margins and prices for Gasoil

– The Oil demand consequently remains very strong through October and rebounds around 300k in oil barrel equivalents

– The Nat Gas net-inflow has been seasonally high in October due to hot weather.

Flows versus actual congestion

We continue to monitor the congestion data on a daily basis and the road congestion is up >5% in October compared to the lows from September. The actual fuel consumption data is yet to fully mirror that, why we expect refiners (in Gasoline space) to load up in the coming weeks.

Chart 1: Actual road congestion versus implied Gasoline demand from the EIA report

Every week we adjust the demand side data in the EIA report for the noise of seasonality and methodology issues. Our view that October would show a strong rebound compared to September has been proven correct, except in Nat Gas.

0 Comments