EIA Watch: September weakness was fake news. Time to buy oil?

Welcome back to our weekly EIA report, where we run through demand and supply data and give our cents on where we are heading next – and what the implications are for energy markets.

As always we present the main conclusions up-front:

1) Oil demand will likely come in hot in November on the back of strong gasoline demand in October due to the lags in energy markets (Gasoline leads oil – not the other way around).

…

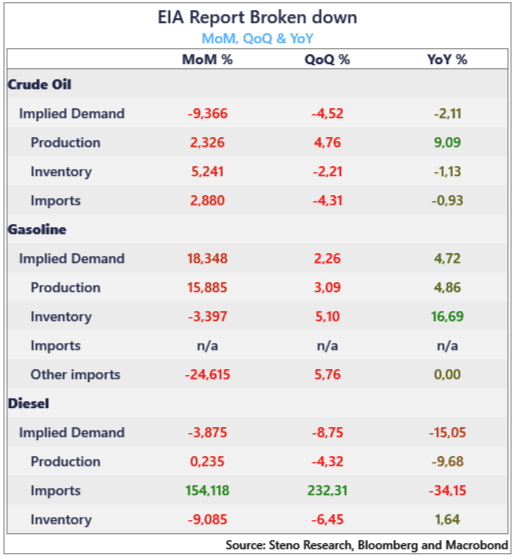

September’s implied demand data took markets by storm with a print way lower than what one would normally expect in September, but as we rightfully forecasted back then, it was not at all in line with high-frequency data, which has become clear as day in this week’s report. Implied demand for gasoline jumped 18,3% compared to last month, while implied demand for diesel and oil keeps dropping (on a NSA basis).

Our full decomposition of the EIA report below:

Chart 1: Big rebound in implied oil demand

The latest EIA report once again shows that September was just a data glimpse, and that oil demand is still going relatively strong in the US. Long oil a bet for the last month of 2023?

0 Comments