ECB & Fed Watch: Closing in on ECB rate cuts, while the Fed is not done hiking

“October’s survey highlighted continued downward pressure on demand for goods and services, with overall inflows of new business posting the steepest decline since May 2020. Indeed, services firms reported their worst sales performance for almost three-and-a-half years, which they attributed in part to client hesitancy and tighter financial conditions.”

– From the press release of the HCOB German Flash PMI

In this piece, we are going to compare the ECB and the Fed case systemically on a set of important parameters to ultimately conclude with our base-case and suggested allocations on the back of it.

We will assess the cases on:

1) Inflation

2) Growth

3) Labour

4) Liquidity

Inflation Watch: The ECB is realistically much closer to claiming victory

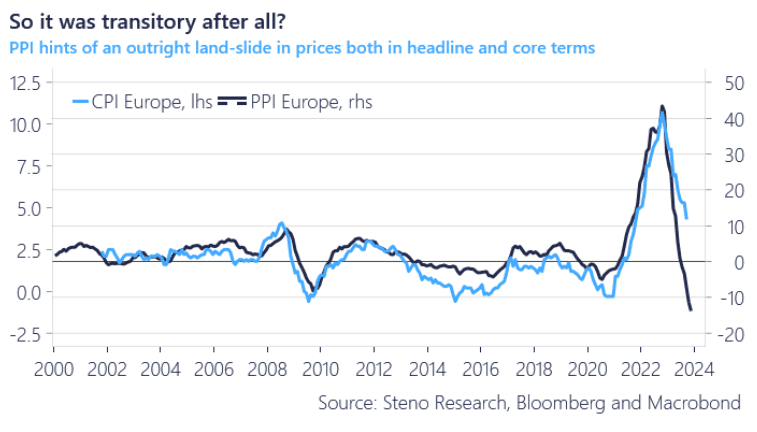

As we have noted since the early summer, we find the probability of sub-2% inflation in the Euro area much larger than in the US. The moves seen lately in producer prices are comforting for our view as the “wheel of inflation” suggests that European producers will have to pass through lower prices unless they can magically improve margins, which seems unlikely given the demand picture in Europe.

Judging from the most recent trends in the European PPIs, we now even have a risk of sub-zero readings in the EUR CPI/HICP in just a few months from now, which would be an outright shocker compared to the current market pricing. The European PPI is likely down around 13% YoY in September

Chart 1: European PPIs are through the floor

If the PPI is any guide, we will soon see the EUR inflation printing below target again, which will allow the ECB to ease since the growth picture remains lackluster as well. The Fed is not close to claiming victory compared to the ECB.

0 Comments