Credit Watch – Why European Housing is likely going further south

Everyone is starting to notice the EZ weakness that we have been pointing out recently, and it is probably the last place you would want to place excess capital currently. But where does this weakness come from?

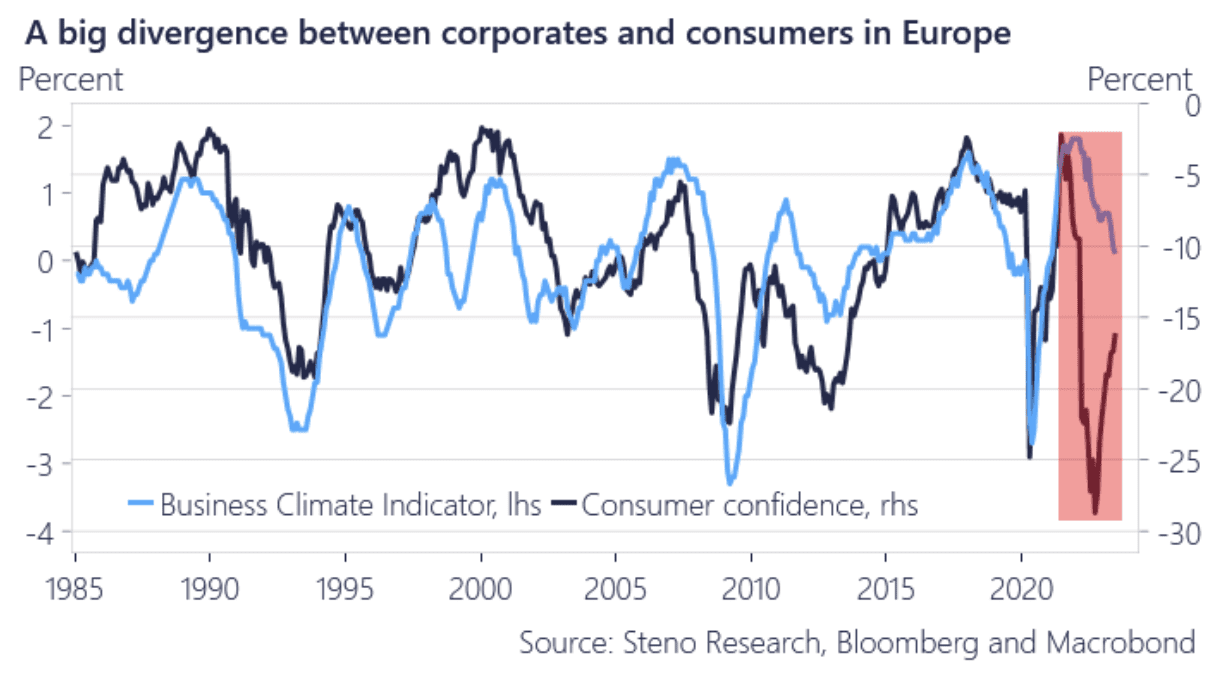

The answer is likely the substantially weak domestic demand, which is the result of years of weakening real wages post-pandemic, paired together with an ongoing fragmentation between North and South (Germany vs Italy etc.) as well as a fairly aggressive hiking cycle from the ECB. From -0,5% rates to 3% in a year certainly doesn’t do anything good for the consumer nor for corporations, and we’re starting to see the effects of it now.

The biggest loser in this is currently the consumer, whom on top of losing purchasing power due to inflation. weren’t as generously compensated compared to companies that were heavily subsidized.

Chart 1: The divergence between consumers and corporates is HUGE

With the recent drop in house lending in the Eurozone, we take a closer look at how exposed European consumers and corporations actually are to further interest rate hikes. A teaser: It doesn’t look particularly great.

0 Comments