Credit Watch – What’s going on with credit spreads?

Increased credit was what brought the economy through a rather turbulent period during the pandemic, and it will likely also be what brings the economy into a recession sooner rather than later, but despite tensions building in the economy, credit spreads remain extremely silent signaling that markets have yet to start worrying about a possible recession. It seems like the soft landing narrative has begun to scratch the surface once again, and that is probably a good sign as to why your alarm bells should start blinking.

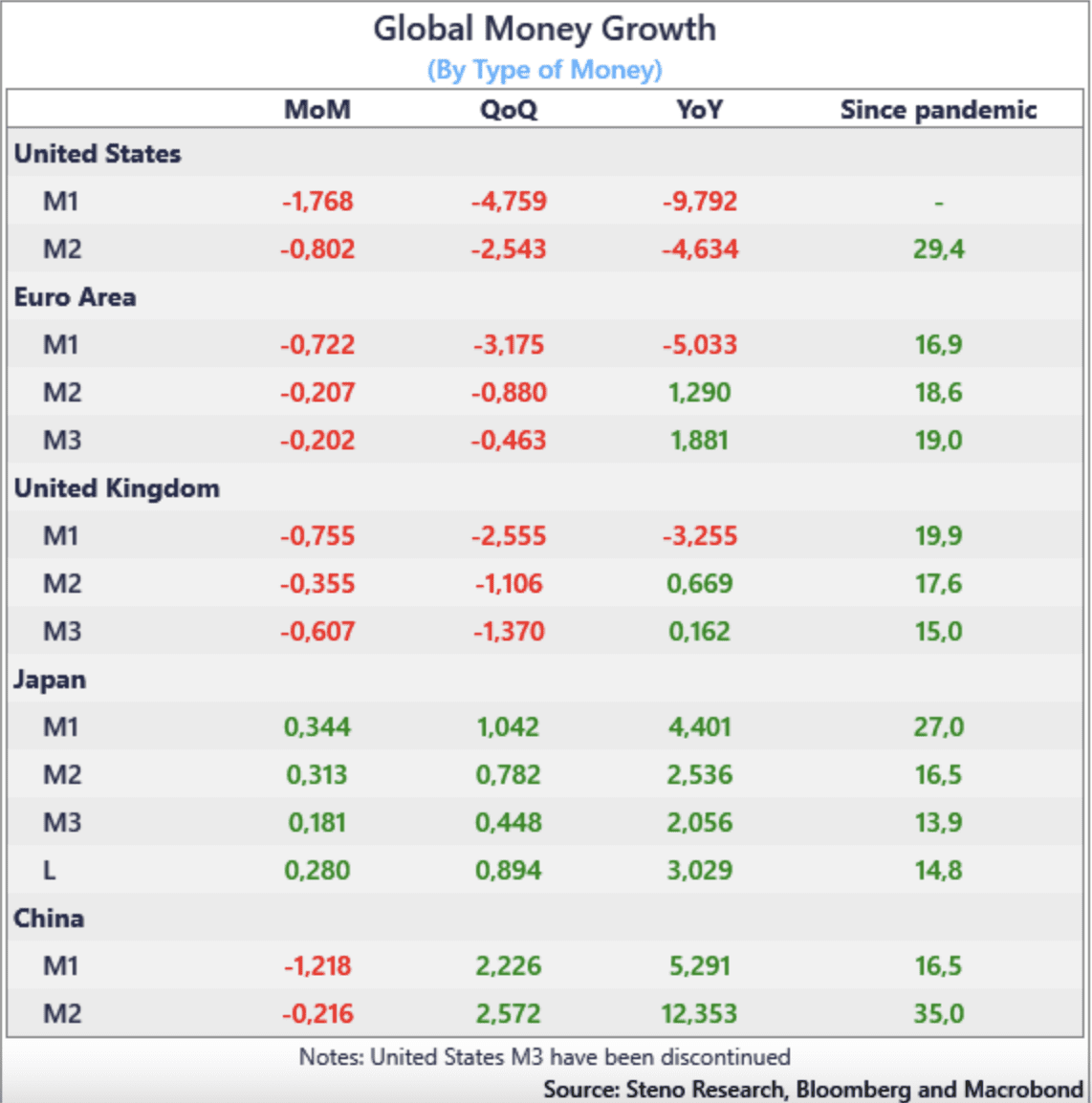

As we have written about before, the growth of money is highly correlated with various economic factors, including CPI, economic growth and equity returns, and hence it shouldn’t come as a surprise that money destruction will be what pulls the economy further towards a slowdown.

While the US was leading what we might as well call the money destruction dashboard in the first half, Europe has come back in the second, with China recently publishing its first negative M1 MoM print in ages. So even in the East, we are beginning to see the same tensions as we’ve seen in the West over the past months.

Chart 1: Money destruction will be THE theme to watch in 2023

While we have been vocal about an upcoming credit crunch, credit spreads are not moving whatsoever. Are the markets wrong, and what’s keeping credit spreads low?

0 Comments