CPI watch: 6 charts on a soft’ish inflation report

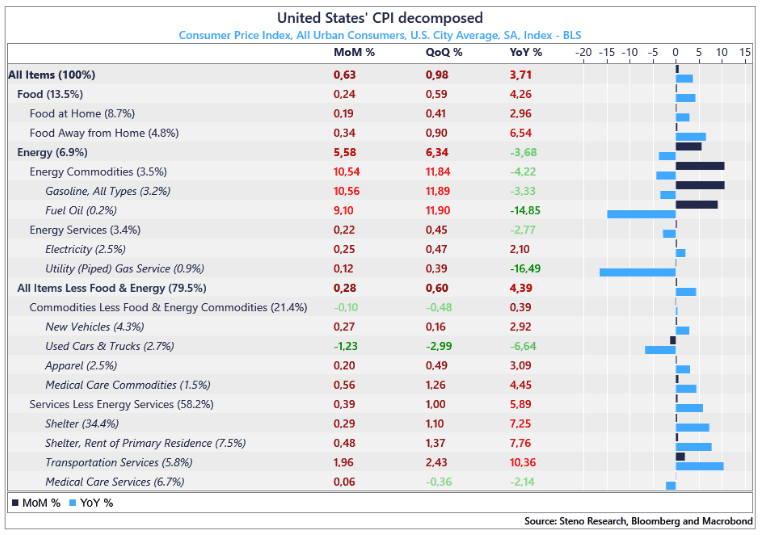

The US inflation report in August turned out to be “hot” due to sharp increases in gasoline -and diesel retail prices, as we anticipated.

>10% monthly increases feed through with strong power and even if some elements of the core basket started to look decently compelling, we still need the final capitulation in transportation services and the Rent of Primary residence.

We see the most risk to the downside on Thursday, especially in core inflation where cars and transportation look ripe to surprise on the low side.^

Chart 1: US CPI decomposed

The US inflation report is likely to look soft and risks are on the low side of consensus estimates, especially for core inflation. The medium-term issue is that our indicators hint of a bottom above 2%.

0 Comments