Commodity Watch: Alternatives to betting directly on the curve

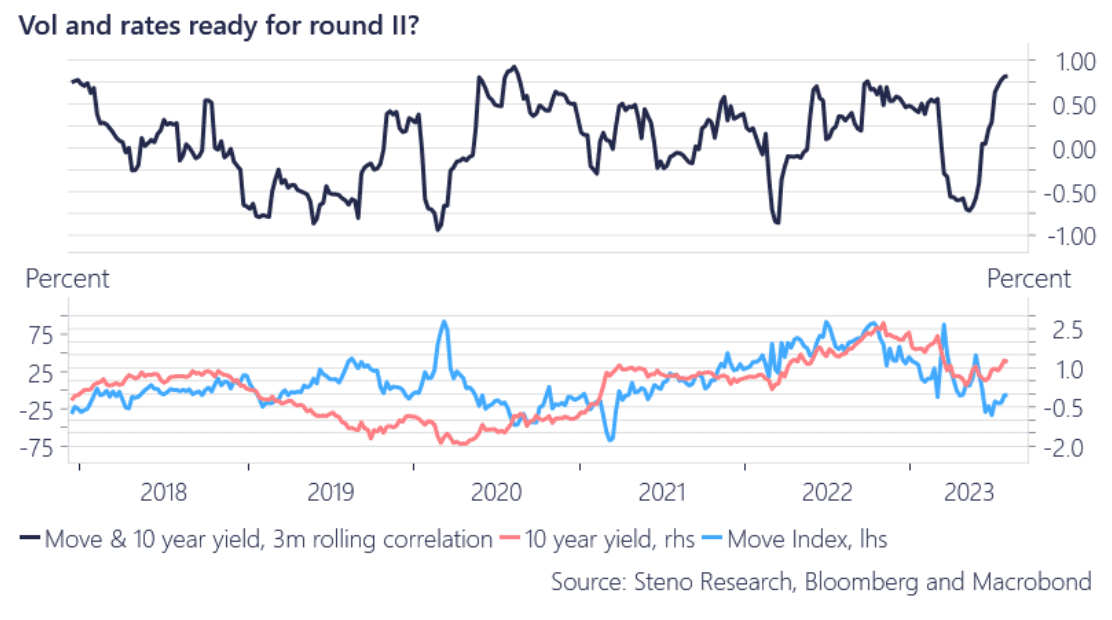

Recently the MOVE and 10 year yield 3m rolling correlation went back to its 2022 levels, so is it time for a cocktail of a rates volatility wrecking ball ala summer 2022 again? Then just short the long end of the curve given the resilient US economy, BoJ’s YCC hikes and a procyclical fiscal policy in the US.

We see this scenario as one in which high duration generation Y & Z assets get hammered and the boomer trade is en vogue.

Chart 1: The Move index and 10 year yield correlation are back to 2022 levels

This week has been all about the yield curve and a potential steepener here at Steno Research. We’ll end the week on a short note for those seeking alternative ways of playing the steepener.

0 Comments