Commodity Watch – A rebound in the most cyclical asset class?

Welcome to the final series of our “Business Cycle Week”, where we cover how a possible rebound in manufacturing might affect asset markets, and if markets are already starting to position for it.

Commodities is the only asset class we need to tick off, and what a way to end the business cycle week with the most cyclical asset of them all, looking to benefit the most from a rebound in manufacturing. Commodities have had a rough 2022 (and start of 2023) as USD strength and a lack of Chinese demand have held commodities prices down, despite the scarcity that characterizes the market currently.

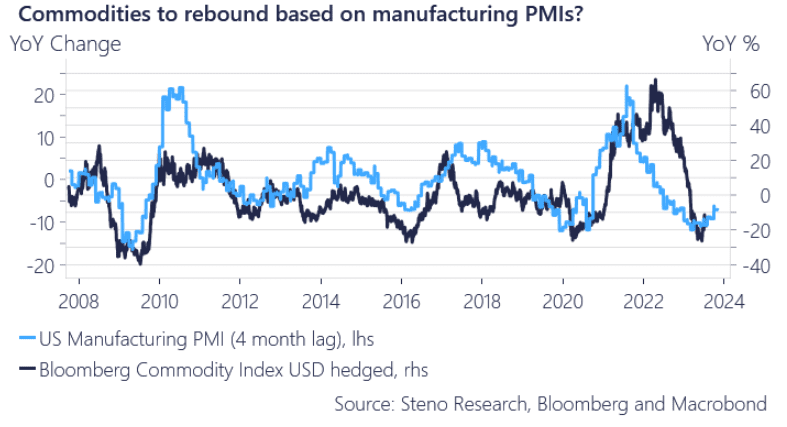

With the dollar weakening after last week’s dovish CPI report, now might be the time for the commodity cycle that everyone talked about – or? If you sort out the currency aspect of commodities, the answer is likely yes if PMIs rebound.

Chart 1: Broad commodities likely to rebound

With the possibility of the manufacturing sector rebounding, commodities might be in for a ride as demand increases in a tight market.

0 Comments