China Week: The reopening play vol 2

Welcome to this “Reopening play” of our ‘China Week’. A chart-packed edition where we’ll try and dissect the latest data showing up on our models and dashboards with relations to China. As always we’ll, without reservations, present to you our immediate thoughts and whether we see any actionable opportunities.

So, is China really open?

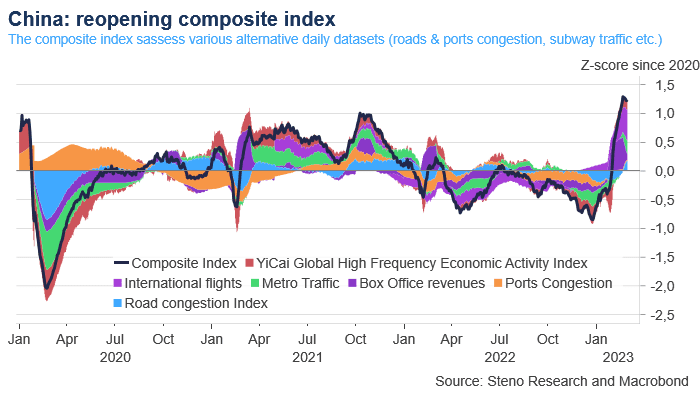

When observing various activity measures, data leaves little room for debate. The Chinese population certainly have been freed from the notorious and far reaching constraints. Flights, traffic, congestion, box office sales and the YiCai Economic Activity index all point to a rapid resurgence in overall activity – 1,5 std. dev from the since-2020 mean.

Chart 1: China IS awakening

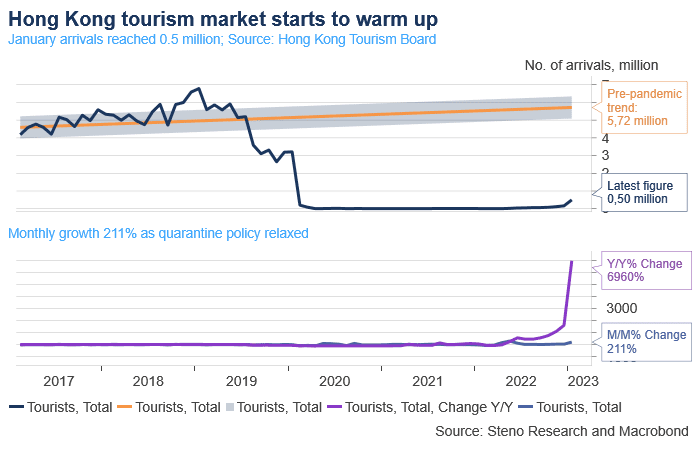

The hypothesis holds water and is in fact further strengthened by data regarding tourism in Hong Kong – China’s laxer than mainland guinea pig. As quarantine policies have been relaxed, tourists have started showing up in the southeastern metropole again. Monthly growth in the number of arrivals has hit 211%.

The hypothesis holds water and is in fact further strengthened by data regarding tourism in Hong Kong – China’s laxer than mainland guinea pig. As quarantine policies have been relaxed, tourists have started showing up in the southeastern metropole again. Monthly growth in the number of arrivals has hit 211%.

Chart 2: Tourist taking the pilgrimage to Hong Kong

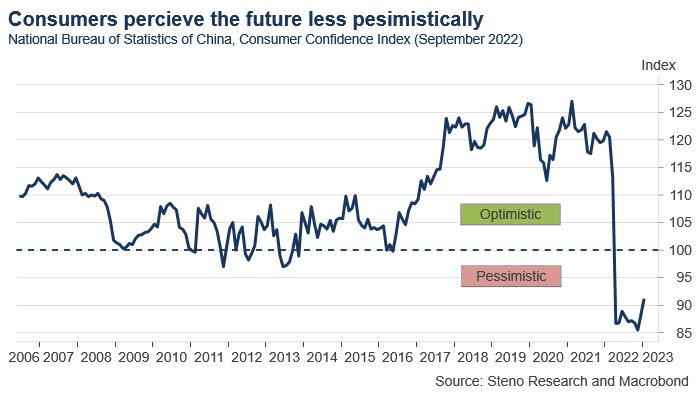

The unshackling of the population has if not infused optimism then at least fought off the worst pessimism among the people. With the fall of the ‘new normal’ people seem to find comfort in things returning to how they used to be. This newly infused optimism ought to influence behavioral patterns, spending, investments and thus overall economic activity. Exactly economic activity is what we’ll turn to next.

Chart 3: Some newly infused optimism

The abiding tale of a Chinese reopening has been about as labile as pundits’ conviction of a soft landing. In fact the two may very well be tightly correlated. Now, it seems data has finally arrived to firmly lay to rest the debate whether a reopening would show. What better time then to unwrap and examine the implications?

0 Comments