China Watch: From a controlled demolition to another round of damage control?

Last time around in our EM series (see here) we made the case that a (potential) pending Chinese stimulus would more than likely be aimed at the supply side and that the reluctance of the Chinese leadership to back anything domestically beyond back-stopping financial fragility caused Real Estate rug-pulling and risks causing more goods-deflation to the RoW later in 2024, which may act as a counterweight to the current momentum in freight rates.

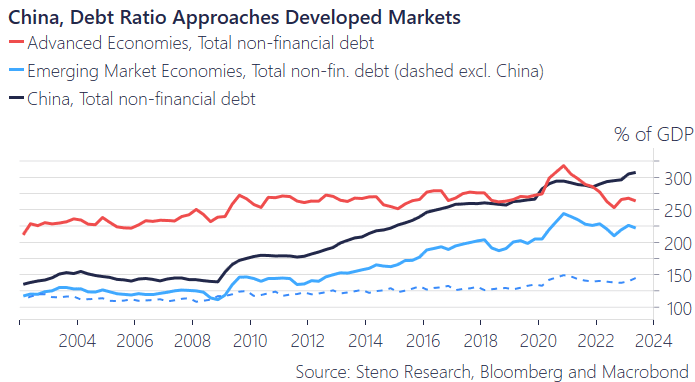

Whether that call comes to fruition is obviously subject to risk but what is beyond dispute is that any policy action aimed at boosting output will necessarily enhance the leverage level which is already at astronomical levels in relative terms

Chart 1: China’s debt levels vs RoW

The drivers of the recent sell-off in Chinese equities mirror the weakness of the Real Estate sector and the two are inherently interlinked. The question is whether the leadership will respond to the sell-off in the same way they did during the Real Estate crisis last year. In such case, fundamentals will remain unadressed. Read our takeaway below

0 Comments