It appears that in the past week, the stewards of monetary policy collectively displayed a loss of confidence. Waller, Knot, and Lagarde all pushed back against the rate cuts that markets had already factored in for 2024. Ironically, this performance unfolded because both Frankfurt and the Fed had opted not to firmly commit or guide policy, thus allowing the market to make its own assumptions.

Not pleased with the implicit easing that the market had been fronting since November, these central bank figures attempted to regain control, and this time it seems to be working. It’s worth noting that our prediction of a stronger price pressure in the US has been largely confirmed over the past few months, whereas the ECB, and to a lesser extent market expectations, had been significantly out of step with inflation data during this period.

We believe that the abrupt market shift, coupled with geopolitical tensions in the Middle East, has persuaded investors to reconsider their dovish sentiment in the yield curve.

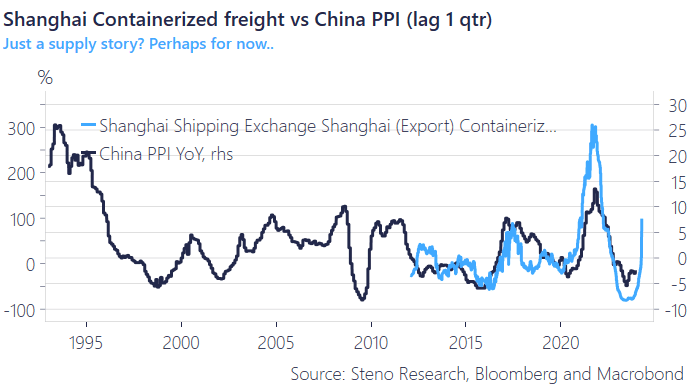

The likelihood of a March cut in US OIS rates is now uncertain, and the chart below certainly plays a role in this evolving scenario

0 Comments