Business Cycle Watch – What if ISM Manufacturing rises to 56?

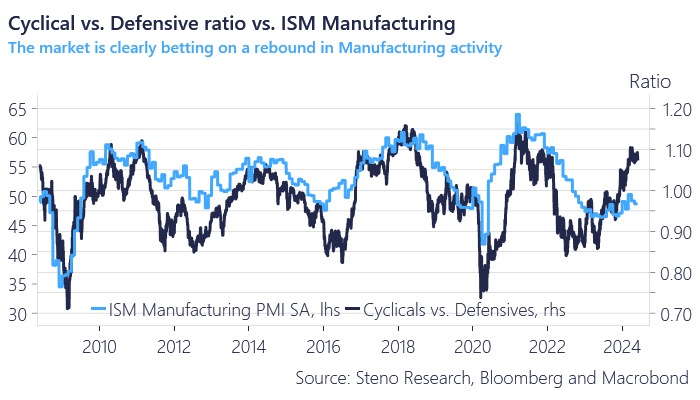

The ISM figure for May surprised negatively Monday, admittedly a short-term setback for the whole reflation story we have laid out over the past months. There are however signs that we could be in for a VERY hot summer/autumn in manufacturing terms, and market pricing in cyclicals vs defensives are still showing support for materially higher ISM manufacturing levels around 56-57.

Chart 1a: Cyclicals vs Defensives

It might seem surprising to discuss the ISM reaching 56, but there are intriguing signs from high-beta economies like Sweden, Germany, Canada, and South Korea. The IFO index suggests a brighter future for the most cyclical components of the German economy, while Sweden’s orders-to-inventory ratio for manufacturers has surged recently, partly driven by rate cuts. Canada is also beginning to show positive trends.

The US cycle likely lags behind these cyclicals due to differences in the debt duration profiles of the respective economies. Empirical data shows that the Swedish PMI leads the ISM activity index by 5-6 months (see chart 1b). A significant jump in ISM above 55 would surprise many, as momentum in the global cycle, long bond yields, commodities, and certain FX pairs are not prepared for it. However, US equities appear somewhat better aligned with this potential shift. Let’s examine the details across asset classes.

Chart 1b: Sweden setting the scene for the US?

Despite the ISM figure for May showing weakness, there are numerous signs from both the market and forward looking indicators that we are in for a substantial boom in manufacturing. What should you buy if that’s the case? Find out here.

0 Comments