Steno Signals #90 – More liquidity to the most hated rally in recent history

Happy Sunday and welcome to our flagship editorial!

Is it the year 2021, 2007 or 1995? These historical analogies are often used in sell-side reports, and we are going to jump the bandwagon with a few semi-fishy analogies today.

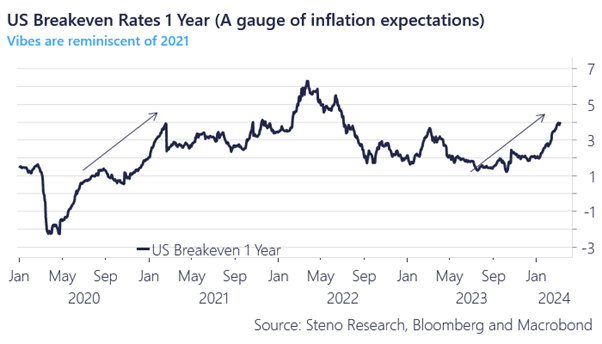

I do get some vibes that are reminiscent of melt-up years ahead of crisis years. Whether you use 2021 and/or 2007, the overall trend is kind of the same. We have entered the year with extreme pessimism on growth but with central banks holding a clear easing bias, while there are some tentative signs that the economy is actually accelerating.

Central banks with easing biases generally allow the economy to reflate as long as we are in the early innings of a reflationary phase. Such vibes are printed all over the Fed and the ECB currently, and Jay Powell didn’t back down from a clear easing bias over the past week despite evidence of sticky inflation and accelerating cyclical growth.

If we are indeed living a 2021-analogue, we are only in the early innings of the melt-up in risk assets, while the setback will only be seen once central banks admit to the reflation.

Chart 1: Break-evens starting to look a bit like 2021?

It feels reminiscent of early 2021 in many ways with a very hated rally that keeps getting liquidity fuel. Central banks remain biased towards easing and will allow the economy to reflate with liquidity.

0 Comments