Steno Signals #87 – Inflation is BACK! Position accordingly..

Happy Sunday and welcome to our flagship editorial!

We are 7 weeks into 2024 and the consensus for the year has already been blown to pieces.

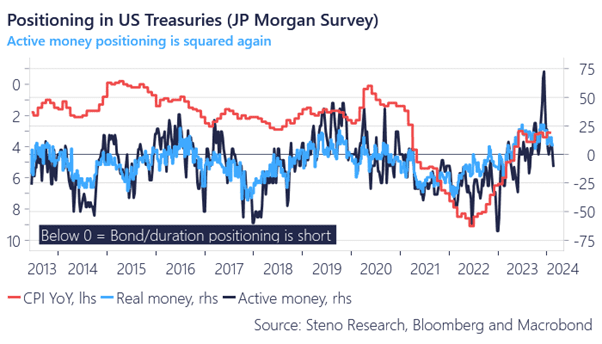

Powells late 2023 pivot led to an almost historical uniformity in rates- and inflation expectations that were probably always bound to be corrected. Survey based measures of positioning hinted of extreme uniformity in views on duration, while no one dared to think of a flare up of inflation.

Here we are a few months later with everyone wrongfooted and all major research houses stuck with legacy views of a massive cutting cycle for 2024.

Was the Powell pivot simply too early? Or was it ill-timed due to already improving financial conditions? We currently struggle to find any decent forward looking indicators seeing inflation in the US lower from here, which is something we have highlighted for a few months. So will the Fed cut at all? Only if they are very hellbent on doing so.

We have also been very surprised by this resurgence in forward-looking inflation indicators, but we have had the right lean on US inflation from the get go of the year due to our data driven process.

Will inflation return to 2% in the US in 2024? Doubtful, but let’s have a look at the indicators and how we trade it.

Chart 1: From a bizarre long due to more balanced US Treasury positioning

Both input- and output prices have flared up in the US and the 2024 consensus on rates and inflation is blown into smithereens. What’s next?

0 Comments