Steno Signals #86 – Trading the relative Fed and ECB balance sheet development

Happy Sunday and welcome to our flagship editorial!

I am sitting here on a Saturday evening (by the time of writing) waiting for the opportunity to say hello to the second junior analyst at home as my wife’s due date is approaching fast. In between the frightening thoughts on how to deal with not only one but two diaper-wearing boys at home (myself excluded), I keep pondering why I receive so many questions on the timing of the first rate cut. Is it really that important?

We all know the drill. All economists and strategists are asked daily to guess on the timing of the first rate cut from the big central banks in an attempt to time whether it will be in March, April or May. In all transparency, none of us know (no shit, Sherlock), and it is honestly tricky to second guess a decision taken by humans, even if the decision-making is at least partially based on data.

We can try and assess the probabilities of certain outcomes and trade it, if we are leaning sharply against the forward pricing on a certain timing, but we typically find greater value and improving hit ratios in trading liquidity developments since they are less prone to a sudden change of tune by a central banker.

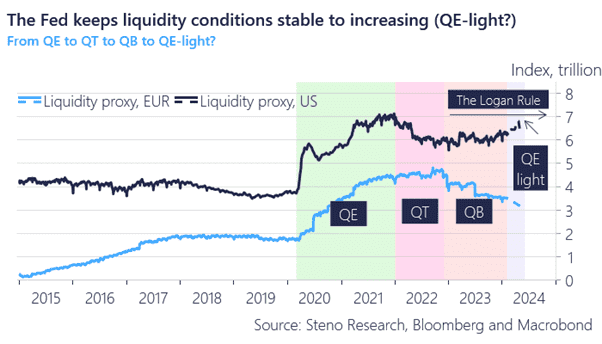

The divergence between USD and EUR liquidity trends is growing and the gap is very tradeable. In the following, I will elaborate on how we view relative balance sheet developments and discuss how to trade them.

Chart 1: A growing divergence between USD and EUR liquidity trends

With an increasingly tricky timing of the first rate cut, we look for tradable trends in balance sheets instead. Balance sheet trends are easier to predict, which makes them very tradeable. Here is why!

0 Comments