Steno Signals #77 – Oil demand is ALL TIME HIGH

Happy Sunday and welcome to our weekly flagship editorial from Steno Research.

It has been an incredibly odd week in the economic calendar and our thesis of a strong year-end for USD key figures has so far been proven right, which especially after the NFP report re-ignited the USD and front-end USD rates, which has been our bet against especially European peers.

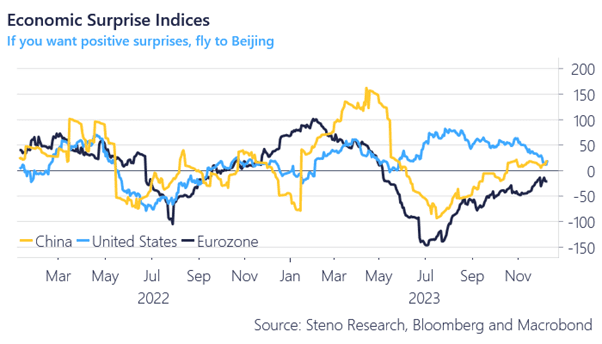

Most recent economic key figures from the US have not surprised positively to the extent we saw through the autumn, while Chinese key figures have woken up and made a decent comeback relative to expectations over the past months. Europe is no longer an outright catastrophe compared to economic forecasts, but the continent remains the weakest link among the big three economies due to a continued weak momentum.

The improving Chinese economic surprise index has helped Asian countries perform versus the USD, while the EUR has been the best vehicle to have on the short side of our USD comeback trade given the continued woes in Europe.

As per usual we’ll walk you through the macro landscape with 2-3 charts from each major macro asset class. Let’s have a look at the details.

Chart of the week: The euro area remains the weakest link from a macro perspective

Judging from the most recent data evidence, it remains hard to see the cracks in the US economy even if they continue to appear in various forward-looking indicators. The oil demand was for example all-time-high in week 48.

0 Comments