Steno Signals #76: The Fed has lost control of liquidity trends

Happy Sunday from frosty Copenhagen and welcome to our flagship editorial!

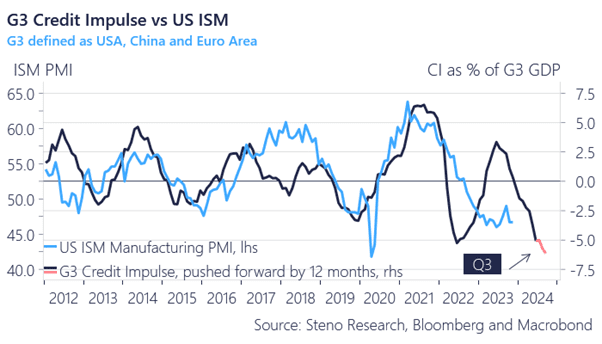

The underlying demand trends are not strong. Running credit card data has been weak in October/November, the credit impulse is worsening and there are signs of actual labour market softening around the otherwise sticky service sectors in the West, yet markets are partying like there is no tomorrow.

What is causing this disconnect and could it continue into the year-end?

As per usual, it seems like the narrative lags the actual price action. 2024 estimates/outlooks are turning upbeat, while positioning is one way traffic towards buying duration in both bond and equity space.

We will try to look at the recent trends through the lens of the best couple of charts from each major macro asset class as per usual. Let’s have a look and elaborate why liquidity trends are out of control at the Fed.

Chart of the week #1: The credit impulse kept weakening in Q3

It is amusing to watch the flow of 2024 outlooks coming in. Suddenly hopes/expectations of soft landings are revised up left, right and center after an immaculate November. Price always leads the narrative, also in this case.

0 Comments