Steno Signals #73 – An abysmal impulse for 2024

Happy Sunday and welcome to our flagship editorial!

As per usual we take you for a chart-heavy guided macro tour around major asset classes.

Let’s have a look at the details!

We have remained upbeat on especially the US economy for the most part of 2023 in contrast to the wrongfooted economic consensus, but the positive impulses driving a better than feared 2023 are now running on fumes.

Momentum in 2023 saw a positive impulse from 1) lower input costs for production due to lower commodity and energy prices than in 2022 and 2) Easing financial conditions due to higher multiples and an easing momentum in rates.

The tide is now turning ahead of 2024 and the starting point is much weaker than in 2022.

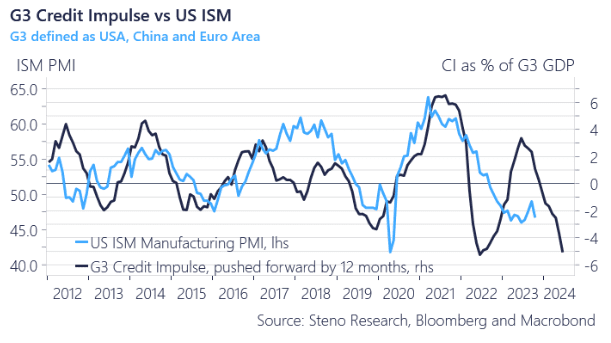

Chart of the week: The credit impulse looks abysmal for 2024

We are currently “riding” a few of the positive impulses from lower input prices over the past year, but the impulses for 2024 do not look good and the positivity is likely going to be short-lived with rates volatility back.

0 Comments