Steno Signals #71 – A first taste of the recession sell-off?

Happy Sunday from a wet and cloudy Copenhagen!

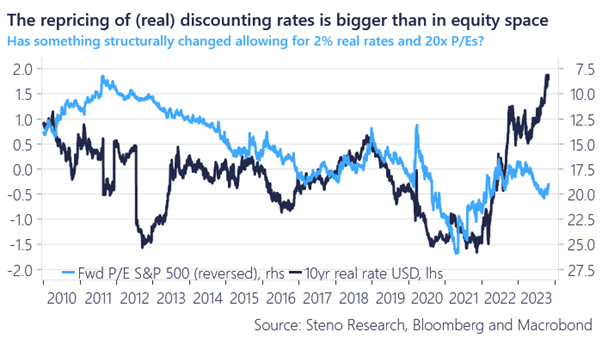

Market fears are back and the rising term premiums and real rates are making their way through cross asset moves.

The biggest question to ask right now is whether the pandemic altered the geopolitical and- financial playing field to an extent that will allow >+2% real rates for the next 10-20 years and whether equity multiples can continue to live in a QE world if QE is no longer a thing.

The repricing of cross asset trends due to rising real rates may not be over yet.

As per usual, we will make our way through all asset classes with the two charts that we watch the closest in each asset class.

Through next week, we will focus on the supply side of Fixed Income, Commodities, Equities and FX/Money in our “Supply side week”.

Chart of the week: Can real rates remain at >2% while equities price at 20x P/Es?

The developments in the Middle East have refueled the recession fears and markets are getting concerned due to the spike in term premiums. Is this a first taste of the recession sell-off coming? Here is how we deal with it.

0 Comments