Steno Signals #68: There is NOT enough buyers for bonds amidst all this

Happy Sunday and welcome to our flagship editorial.

Conclusions up front:

– A deal between the US/Israel and Saudi Arabia seems off the table after this weekend

– Oil markets are physically tight still, but there are some signs of cracks in demand

– Nat gas markets have started to rally, which is another issue for EUR, GBP and JPY markets

– We find no compelling risk/reward in equity longs and continue to express ourselves via steepeners, energy proxies and FX bets

What a week in bond- and energy markets. The disturbing developments in Israel/Gaza this weekend only adds to an already elevated geopolitical premium in oil- and bond markets and the early hopes of Saudi Arabia coming to terms with Israel / USA on an oil deal from January 2024, now seem very very distant.

As we have said over and over in recent weeks, the world needs a Riyahd accord (to increase oil production) more than ever, why the timing of the developments in Israel should likely be viewed in the context of that.

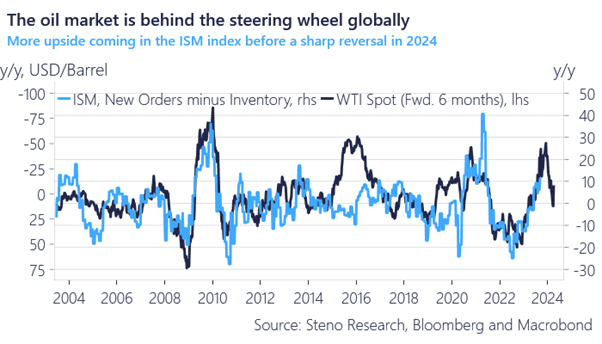

The oil market is behind the steering wheel in global macro and we find the playbook to be straightforward but highly contrarian. The cyclical momentum in the US manufacturing economy will keep gaining momentum until early 2024, but it will prove to be a major false flag as consumers can no longer cope with continued cost pressures.

The restocking cycle will be short-lived but it is too early to bet on that. A recession in likely in Q1-2024, and here is how to allocate for it.

Chart 1: Oil markets predict ISM up before down

Public deficits are running wild, while the risk of another war that needs ongoing funding is growing. US households have net bought loads of US Treasuries, but will they continue in light of ongoing disappointments?

0 Comments