Steno Signals #57 – What on earth is going on with the USD?

Happy Sunday and welcome to our weekly flagship publication “Steno Signals”.

We have had a great week trading-wise except for being stopped out in our EUR/USD shorts and we find the price action in the USD extremely interesting to assess. Could the moves we see in FX space be a harbinger of an unexpected cyclical rebound? Or is the FX market structurally changing due to the rising global yields over the past quarters?

Let’s have a look at the evidence here.

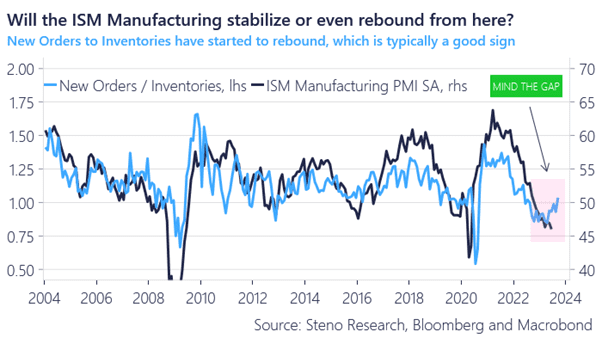

We cannot discard the possibility of a rebound in the most cyclical parts of the economy at this juncture. New Orders to Inventories have improved marginally over the past months, which is typically an early sign that overall activity will follow and only weak order back-logs speak against this view currently.

Find out how we position for a stabilization of the Manufacturing Cycle with a 14-day trial below.

Chart 1: Will the Manufacturing cycle make a short-term comeback?

The USD has weakened materially over the past weeks, which could be an early harbinger of an improving growth cycle. If cyclical growth is indeed rebounding, right about everyone will be wrongfooted. Here is how we position for it..

0 Comments