Steno Signals #53 – 3 reasons why incentives will drive everything

Happy Sunday and welcome to our flagship editorial!

Has the Fed actually paused? The jury is obviously still out, but let us deliver a few pros and cons of that view before moving on.

In favour of the actual pause:

1) It is central bank 101 to embed a hiking bias in a well-orchestrated pause to ensure that expectations are not extrapolated directly into rate cuts

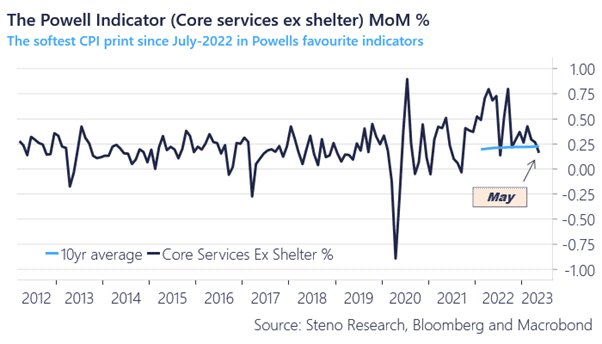

2) Powell-flation is running below 10yr averages (Core services ex shelter – see chart 1)

3) June inflation looks soft on most indicators

In favour of a stop and go policy:

1) The dot plot

2) The FOMC still has a large hawkish minority that likely would have liked to hike in June but got promises in continued hikes down the road

3) Core PCE is moving sideways

We find the three upper arguments to have slightly more weight than the lower, but it is a tough call currently.

If the PAUSE is actually here, it will lead to a cascade of incentives-driven decisions in weeks ahead. Here are 3 reasons why incentives will matter more than usual over the next couple of months.

Chart 1:”Powell-flation” in the CPI is running below 10yr averages now

Incentives will matter a lot in coming weeks and months if the Fed has actually paused. Interest rate volatility is likely to come down, which mechanically leads to increased risk appetite.

0 Comments