Steno Signals #43 – Slow walking into a recessionary credit crunch

Happy Easter Sunday and welcome to our flagship editorial!

We covered the banking crisis extensively at Steno Research and ultimately concluded that this was THE trigger event that every bearish economist had been waiting for. The recession is likely to arrive, but we are probably slow-walking into it rather than crashing into a brick-wall at highway speed.

My friend Jim Bianco has hilariously labelled the current situation a bank walk as a picture of a slower moving bank run and it is a very telling terminology. We are slowly but surely slow-walking into an outright credit crunch in H2-2023.

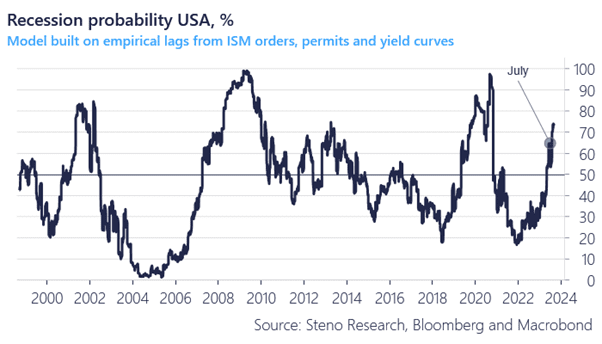

Our empirically tested recession probability monitor is also starting to remove the last doubts. Based on incoming orders and permits data from this week, the recession probability is now >75% for Q3-2023, which is already turning into a consensus view by the way.

Give our research a try for FREE over a 14 day trial to find out what to buy and sell during a credit crunch. You can use the discount code “crisis20” to get 20% off your subscription. The offer ends soon!

Chart 1: Recession to arrive in Q3 with a relatively high certainty now

Evidence is gathering that the SVB-fueled banking stress indeed will turn into a recession, but instead of a fast and rapid liquidity driven recession, we are rather slow-walking into a credit crunch over summer.

0 Comments