Steno Signals #112 – Liquidity is BOTTOMING

Happy Sunday, folks!

I hope you’ve enjoyed the weekend. After a bizarre week, starting with the rug-pulling in Japan on Monday morning, it was time for a well-deserved break over the past two days.

We’ve encountered tons of questions about the size of the USDJPY carry trade, and here’s what we’ll say on the topic: Those claiming that the carry trade is 10-20 trillion USD have very little understanding of the netting of derivatives and/or the FX hedging policies of international investors.

Big Japanese investors roll an FX swap against their USD exposures, while US investors have had every reason in the world to FX hedge their JPY investments. The “naked” USDJPY exposure is therefore much smaller than the bizarre estimates currently circulating, and we are likely close to being fully squared up in the “naked USDJPY trade” in markets by now.

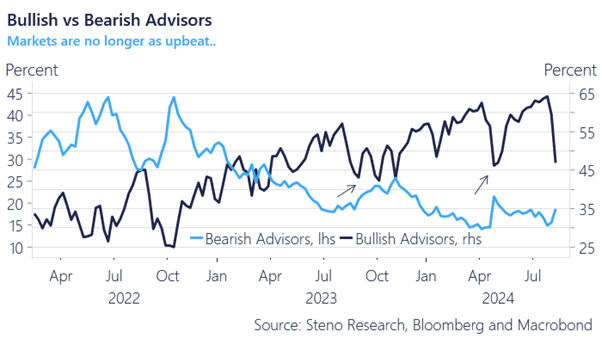

Accordingly, we find it a great opportunity to bet against the landslide in bullish advisors and market participants, especially since there are signs of a bottom in liquidity. Below, you will find the two most important charts we are watching on liquidity, inflation, and growth.

Chart of the week: Advisors are turning pessimistic again..

Liquidity is stabilizing, and there are already signs that August will be better than July. We are aware of the risks in the labor markets, but we see strong signs of a cyclical bottom here, which may soften the impact of the uptick in unemployment.

0 Comments