Steno Signals #109 – What if we are all wrong on liquidity, rates and commodities?

Happy Sunday and welcome to our weekly flagship editorial!

Today, I am going to address three main topics of concern for investors given the current conflicting signals from the US economy. These are the key questions I will address, and I will summarize both the pros and cons of each viewpoint, including my own bottom line:

- Is liquidity no longer improving, but rather at risk of weakening in the coming months?

- Is the economy accelerating rather than slowing?

- Is the commodity complex heavily undervalued or overvalued?

The equity rotation paired with the sharp sell-off in Tech has had me thinking, and we therefore need to litmus-test every corner of our current thesis. Follow along below.

Theme 1: Is liquidity no longer improving, but rather at risk of weakening in the coming months?

This is probably the key question for high-beta risk assets such as Technology and Consumer Discretionary sectors. The rotation seen over the past 10-12 days is material, and we are accordingly testing our positive liquidity thesis daily. So far, we remain calm about the direction of travel, but there are a few caveats.

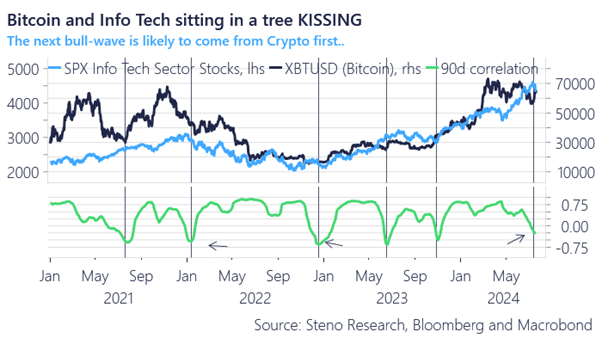

We have seen early signs of a new bull wave in Bitcoin and the broader Crypto complex. One notable observation is that Crypto has led the way every time the rolling correlation between Tech stocks and Crypto has turned substantially negative.

There is a flawless hit ratio in betting on Crypto when the correlation has flipped markedly below 0%, as it has now.

Chart 1: Crypto leading the way in this bull-wave again?

What if the Fed is wrong, we are wrong, and the consensus is wrong? Here’s a look at liquidity, rates, and commodities amidst a macro landscape with a very broad outcome space for the coming 12-18 months.

0 Comments