Reflation Watch: Has Japan turned a page, and have markets gotten ahead of themselves?

Stagnant growth and price deflation have defined the term Japanization, and, due to rapidly rising debt levels in conjunction with aging populations, long been the striking worry for many economists. Post-Covid inflation has shifted the narrative however, and fears of it becoming structural has taken over as the new doom-scenario globally.

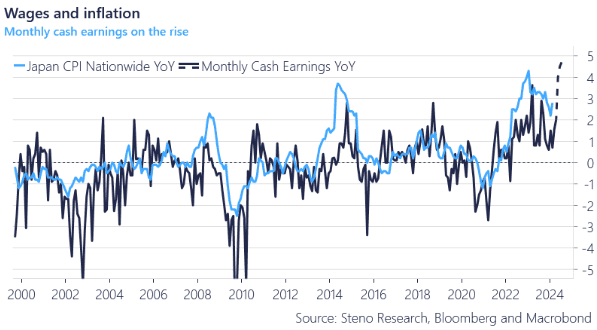

For Japan though, inflation is not so much a fear as a hope, and we see signs that Japan is in fact achieving sustained inflation. Rengo, Japan’s largest union, confirmed Friday that Japanese companies have agreed to a 5.25% increase in wages this year, marking the most significant increase since 2013.

It now looks increasingly likely that these “bluechip” wage deals will trickle down in Japan to an extent that exceeds what we have been used to in recent decades. Smaller firms will reach agreements in April-June, with the next indications due mid-April.

Though we expect the average growth to come down as agreements are made (as they tend to), increases will still be historically high and likely >4%.

Chart 1: Historic wage increases point to further inflation

The BoJ delivered a historical hike – its first in 17 years – last week. Does this mark the turning point for Japan for good, or do risks still linger?

0 Comments