Out of the Box #6: The Europeanization of the US banking system is on its way!

In our “out of the box” series, we aim at being ahead of the current consensus narrative and think of the next theme that could drive price action before anyone else has given it any noteworthy attention.

In this edition, we will elaborate on the likely increase in capital/reserve requirements in the US on the back of the deposit crisis. What if reserve requirements are reintroduced in a tougher edition?

In May, we wrote that the following three conclusions would soon be made by regulators. A month later, both the ECB and the Fed ponder tougher capital and liquidity requirements for banks due to post-GFC legislation not passing a reality test in 2023.

- Reported LCR ratios have already proven to be hot air due to flawed assumptions underlying them

- Banks will have to be punished to a larger extent for holding corporate deposits relative to household deposits

- Consequently, banks will have to increase buffers of cash equivalents (bonds) at a time when true cash (central bank reserves) dwindle

A WSJ article suggested on Monday that US banks will be required to hold up to 20% more capital should the Basel rules be fully implemented by 2025. The Fed is likely to present a new direction for regulation by the end of this month according to sources. This is in many ways old news outside of the source hinting of a release of some guidance already this month.

At this juncture, the new set of rules is mostly based on a guessing game, but Randal Quarles (former vice-chair at the Fed) hinted already in 2021 that a full implementation of the Basel rules would lead to a 20% increase in capital requirements for bigger banks, but how will it impact liquidity and credit in case?

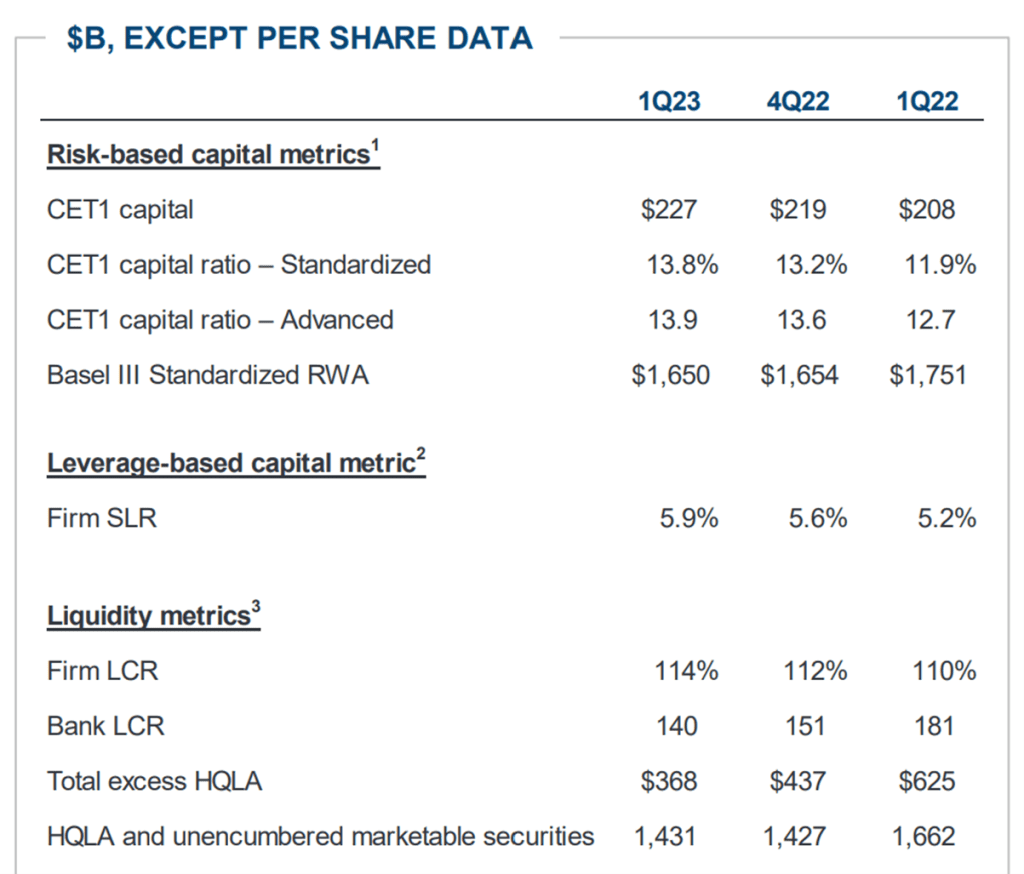

Let’s use the case of JP Morgan to exemplify the effects. JP Morgan would likely be asked to increase capital buffers by 20% in a worst case scenario. The capital requirements refer to the CET1 capital in reserve to absorb losses on risk-weighted assets. Should JP Morgan be asked to increase the buffer by 20% from today’s levels, they would have to raise 45$bn in additional CET1 capital.

Chart 1: JPM Q1 quarter earnings report

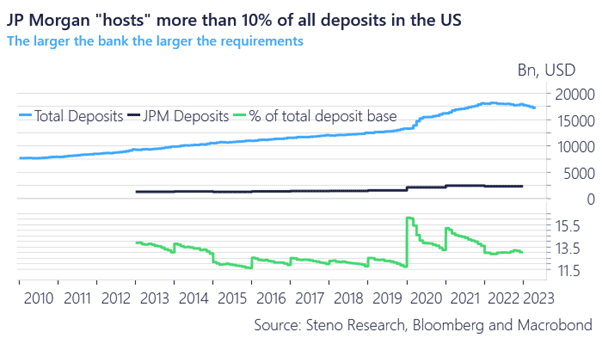

Should we take JP Morgan as a perfect proxy for the entire financial system, the total CET1 requirement increase would roughly have to a little less 7.5x 45$bn as JP Morgan “hosts” around 13.5% of the total deposit base of the US financial system.

An increase of $300-350bn in CET1 requirements would obviously lead to less risk-taking and less availability of credit, but we would argue that market participants should fear new (old) liquidity rules even more. Here is why..

Chart 2: JPM as a % of the total financial system

A reintroduction of required reserves?

The liquidity ratios of banks will be put under scrutiny alongside the capital requirements. A reintroduction of tougher reserve/liquidity requirements looks much more likely than an increase to the capital buffers of large banks. A required reserve is essentially a minimum requirement of digital cash USDs held at the Fed as part of the HQLA portfolio that is designed to be able to meet a stressed outflow of deposits. These USDs will be held idle at bank treasuries should the legislation be reintroduced and lead to a “freeze” of a certain amount of USDs in the intra-bank system.

At first glance, we actually thought that the source speaking to the WSJ yesterday referred to a reintroduction of the so-called “reserve requirements”.

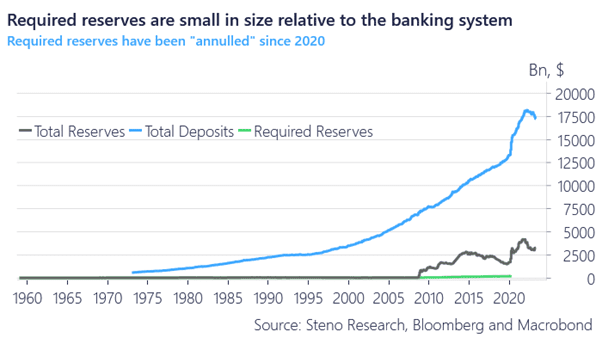

Reserve requirements were scrapped in the early innings of the pandemic to ensure that the required reserves did not skyrocket alongside the explosion in deposits created by the unprecedented QE pace from the Fed. The supervisory board previously set a zero reserve requirement for banks with so-called eligible deposits up to $16 million, 3% for banks up to $122.3 million, and 10% thereafter.

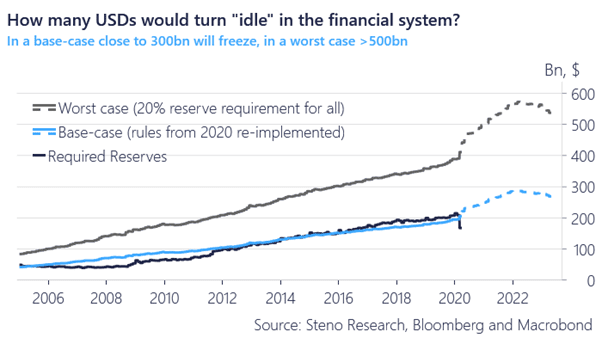

Chart 3: How big is the required reserves base compared to the size of the system?

Required reserves peaked at >$200bn just ahead of the pandemic and if we allow actual deposits to predict the size of the required reserve base had similar rules been in place today, we would have reached levels close to the $300bn mark.

In a worst case scenario, where reserve requirements reach 20% (2014 levels in China) of eligible deposits, current deposit levels would entail a required reserve between $550-600bn.

Remember that there are currently 0, as in ZERO, required USD reserves in the US financial system.

Chart 4: How many USDs would be required in reserves should the legislation be reintroduced?

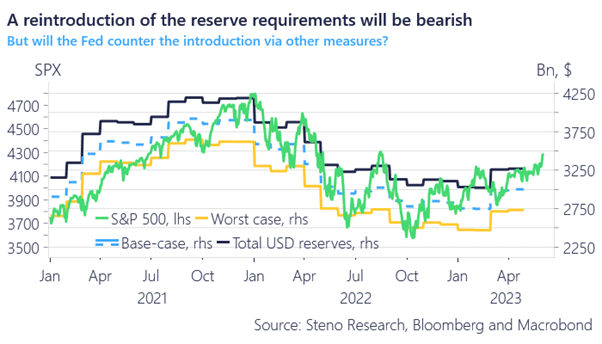

A reintroduction of required reserves would be bearish on the surface as the amount of USDs in excess in the financial system would shrink. If we deduct the base-case (a reintroduction of the 2019 rules set) and the worst-case for required reserves from the total USD reserves, liquidity based fair values of the SPX drop to 4000 and 3750 respectively.

Chart 5: Liquidity based projections for S&P 500 in various scenarios

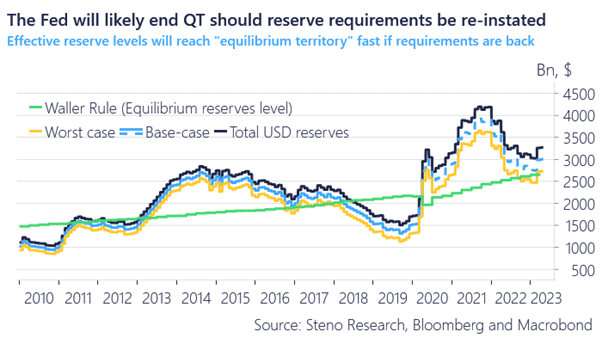

Excess reserves would close in on equilibrium levels fast should minimum requirements be reintroduced. Chris Waller of the FOMC has introduced the rule of thumb that reserves are in equilibrium with the economy if they correspond to 10% of the GDP-level.

Excess reserves would close in on equilibrium levels fast should minimum requirements be reintroduced. Chris Waller of the FOMC has introduced the rule of thumb that reserves are in equilibrium with the economy if they correspond to 10% of the GDP-level.

Increased reserve requirements would in other words likely be met with an immediate end to QT as equilibrium levels would be reached.

This is likely still a discussion for 2024 at the earliest, but we would not be surprised to see news on the direction of travel for future legislation already this summer.

The end-game is likely increased buffers and bond/cash holdings of banks. Bad for credit and lending growth but good for Government Bonds.

.. And don’t get too worked up by future returns in US large cap banks should these regulatory requirements re-enter the frame. The Europeanization of the US banking system is on its way!

Chart 6: A reintroduction of reserve requirements would end QT immediately

0 Comments