Nuclear Nugget (FREE): 3 Questions For The Nuclear Space

Fun fact: In 2009 there were about 35.000 people employed in the nuclear industry in Germany, which at that time produced 135 TWh of electricity. In 2016 there were 160.000 people employed in the German wind turbine industry which produced a total of 80 TWh of electricity.

Question 1: What is the overall supply and demand outlook?

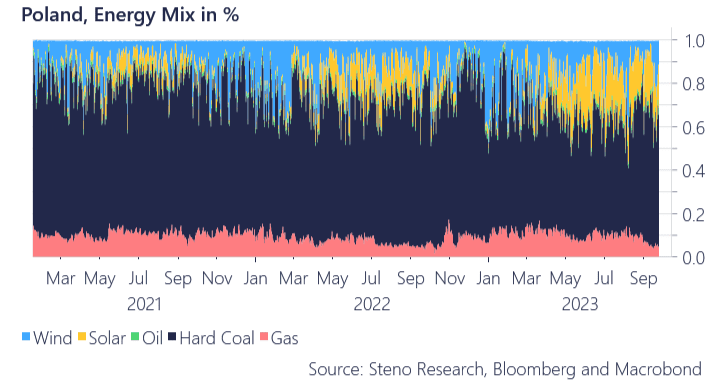

Let’s start with the demand side of the equation where we note an increasing adaptation of nuclear energy production. Take Poland for instance whose energy mix is, to say the least, heavy on old black energy sources. This week Poland issued an environmental permit for the construction of its first nuclear power plant which is scheduled for 2033 by which time Poland will be able to deliver 6-9 gigawatts of energy, enough to power 8 mln homes. We also note that Poland, along with other countries, has received financial help from the US in a push to expand nuclear energy.

Chart 1: The Polish energy mix is a heavy polluter

It is not just in Europe that advances are being made to move towards nuclear. Saudi Arabia has also moved to implement nuclear energy by rescinding outdated rules that have been a hindrance to its nuclear advances. MBS kills two birds with one stone in this move by also moving towards being able to enrich his own uranium for weapon use.

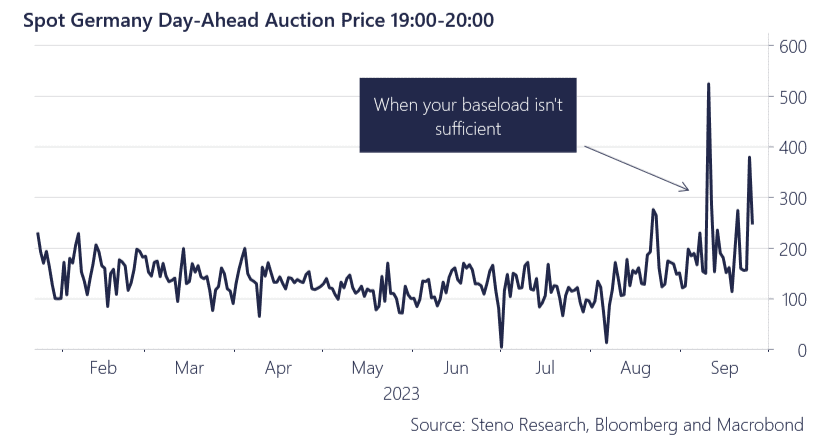

We would argue that nuclear is the inevitable choice if we want a reliable baseload combined with clean energy. Currently, the mood in Europe is changing where we have been ‘Green lovers’ right up till the point where the bills start to show up. To take the Europe-wide windmill tenders which fail catastrophically due to high operation costs as we have covered, but the effects are also showing up politically as it coincides with AfD gaining steam in the polls in Germany. So the consequences of not having a sufficient baseload you ask? Look no further than the below chart with bizarre price spikes during electricity rush hour.

Chart 2: Germany prone to bizarre price swings during electricity rush hour

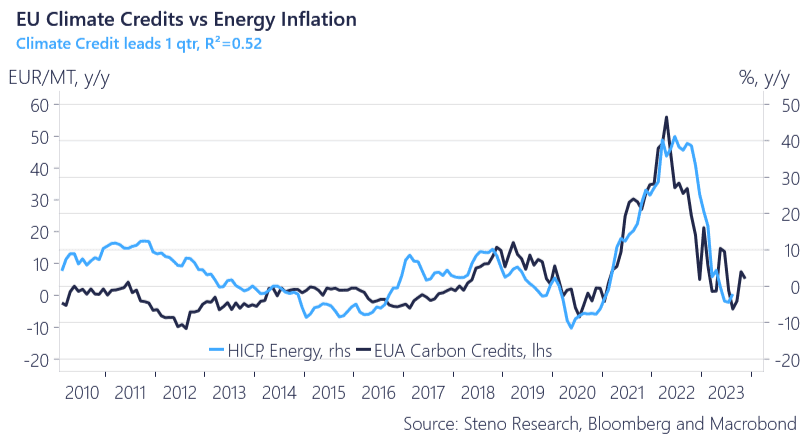

And we see further reasons for accelerating European energy-flation due to at least 2 factors. 1) Climate credits are turning into a net “positive impulse” for energy-inflation again, which goes hand in hand with 2) A slight tick-up in industrial activity and demand for energy resources such as natural gas.

Chart 3: Get ready for more energy inflation Europe

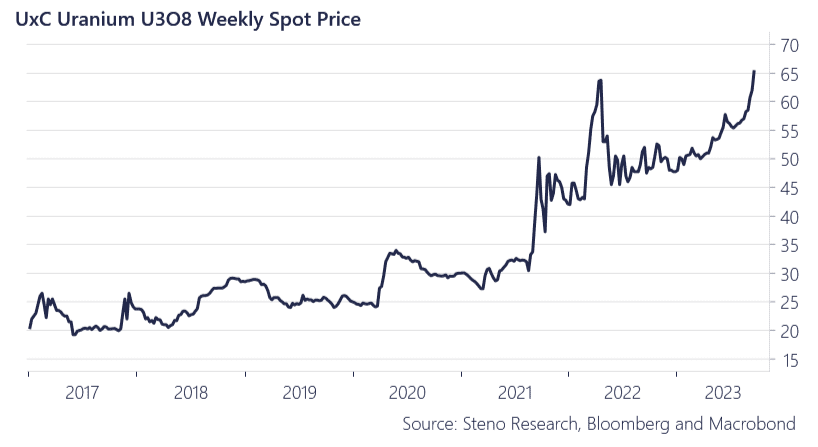

Over to the supply side which is very tight because most suppliers are sold out due to long-term contracts. This means that very small volumes in the spot market can make prices go up and down. But why buy now, if the nuclear story is 5-10 years out? Well if you don’t secure uranium now then a utility company might end up with a multi-billion dollar asset that is no good so fuel has to be secured. That’s why people rush in to get their hands on uranium now.

One player who has taken advantage of the wild uranium month is Sprott Uranium Trust who last week raised money without buying any uranium which is now creating a quasi floor under spot uranium. Sprott sits with USD 59.7m in cash in their balance sheet while trading just with a slight premium to NAV. As mentioned above the big spot sellers are moving to long-term contracts instead of being in the spot market. This means less U308 is available for spot selling and when utilities have to spot buy the market becomes tight and so very simply with a tighter spot market you need less money to create a floor.

Chart 4: Uranium to the moon

Question 2: What are the retail options?

For retail investors, there is a plethora of options both on the equity side and in the underlying commodity. With the tightness in the current market, you can either be in the spot market like the Sprott ETF or in the futures market and get a positive roll yield on up due to the backwardation in the curve.

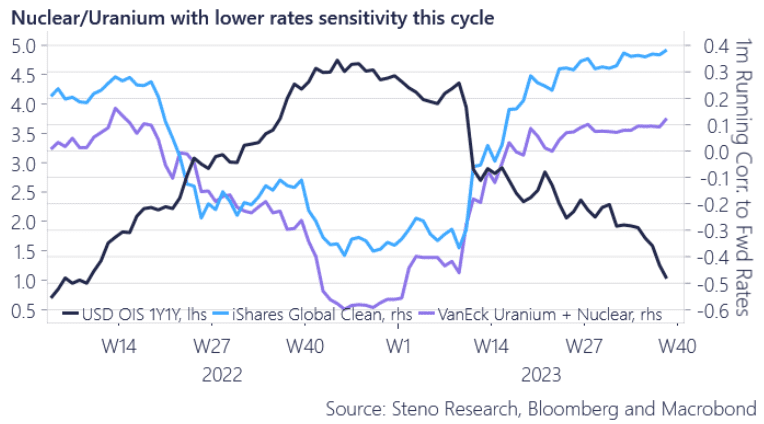

In the equity space the nuclear and uranium ETF from VanEck has proven itself as a lower rate-sensitive equity ETF than its woke brother from iShares Global Clean Energy. If you believe that the green transformation will lead to more inflation and that central banks will be more restrictive as a consequence then nuclear/uranium might be the place to be.

Chart 5: Energy betas to rates

Question 3: How feasible is the Nuclear market for a large investor?

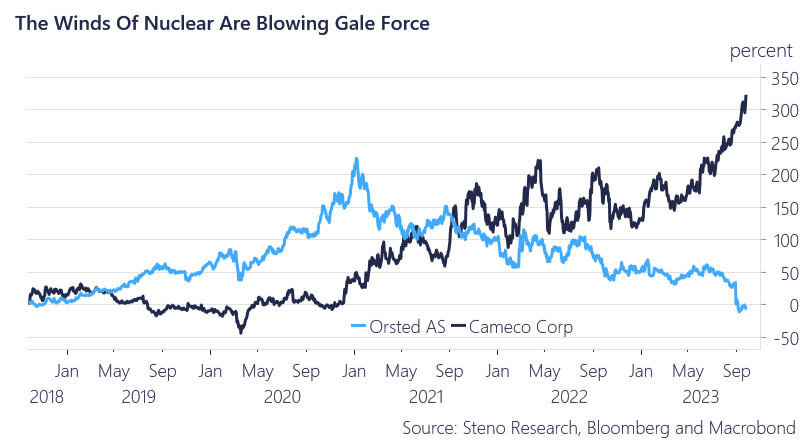

Many large investors such as pension funds etc. may be hampered by ESG ratings which constrain them from investing in uranium and/or nuclear energy equities but that might change with the increasing acceptance. Take the EU taxonomy from last year which green-lights nuclear. It has been met with lawsuits but nevertheless, it is a sign that the requirements going into ESG rating may be changing. We can also see it in the ESG Indicator Ownership of Orsted and Cameco (Asset managers labeling their investment in an equity as ESG), which according to Bloomberg data is 2.62% of Cameco and 12.05% of Orsted. Looking at the below chart we bet that there are plenty of asset managers out there who would love to be able to be invested in Cameco as opposed to Orsted. And this is by the way with the cost of capital of Cameco which is currently nearly double as high (15%) as Orsted according to BBG.

Chart 6: Cameco outrunning Orsted over the last 5 years

2 Comments

hi – for the record you should call climate credits “carbon allowances”. I think that is what you mean. These are not the same as carbon credits. Allowances fall under the EU ETS and are a legal requirement fyi.

On Uramium I also read that Yellow Cake has just completed a $125mm placement which, presumably, will allow it to purchase more spot U308

Hi David. Yes, you are right. Thank you for correcting. Have a nice weekend