EM Watch: The China bet and the copper story are both old hat by now

Welcome to our weekly EM editorial where we travel across the liquid EM markets in the context of recent developments in USD markets.

ISM Services jumped back to 53.8—time to put that recession chatter to bed for a few months again?

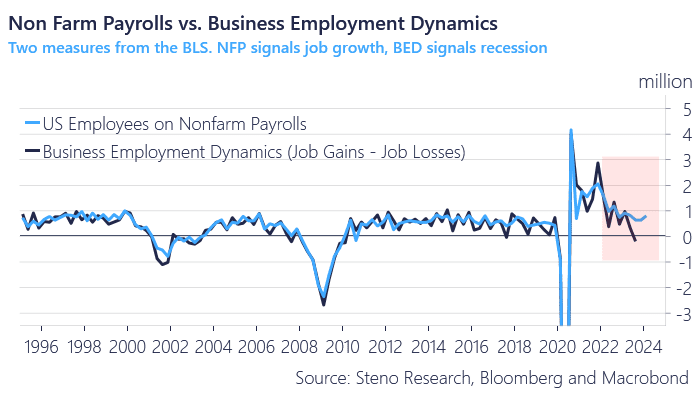

Bloomberg’s latest alarmist piece on “business employment dynamics” showing a net job loss in Q3 of last year is probably the worst analysis I have read in a while. The study uses the BED employment dynamics, a much more limited data set compared to the broad establishment survey (QCW), which, by the way, is conducted on 95% of the entire maximum sample. There’s no doubt the QCW data is more precise.

This is yet another issue with seasonal adjustments when netting gains versus losses in the BED. It makes sense that the NFP is buoyed by “tiny employers,” as more than 20% of all job openings are posted by these small businesses (1-9 employees), aligning perfectly with the high birth-to-death adjustment of businesses in the NFP gauge. Yes, the labor market is slowing, but it’s not dramatic and the NFP report will likely be decent this week again.

This context should shed some light on the recent moves in the EM space and highlight just how overblown the recession scare in the USD market seems once again.

Chart 1a: The NFP is simply a better measure than the BED

The short-term macro bet on the Chinese build-up of copper reserves seems more than exhausted. Cluster risks remain excessive in copper contracts maturing in July, while Lat-Am could be an interesting middleman bet in the meantime.

0 Comments