EM Watch: Have Copper markets been hit by a bus full of tourists or by the Chinese economy?

Copper markets have been on a tear in recent months and our assessment is that the positive sentiment started when Chinese copper stock data points started supporting the notion that China was “hoarding” Copper concentrate ahead of 1) a devaluation, 2) an overhaul of the electrical grid or 3) a power grab on supply chains for EVs, Solar Panels, Data centers and the likes.

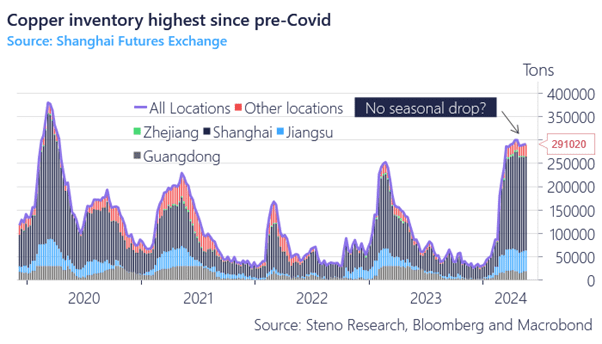

On top of this, we have seen how US officials have highlighted the option of creating a strategic reserve of Copper Cathode in the US, potentially in response to the stockpiling of refined copper seen in China (chart 1). Why is the Chinese copper stock not receding here? That is the question macro-managers and geopolitical pundits are asking themselves daily!

A build-up of stock would not be a particularly bullish medium-term signal, unless it is seen as a permanent alteration of the playing field, and it seems like macro managers currently buy that notion right, left and center.

Chart 1: Why are Chinese inventories not receding?

The front-month Copper bet has been extremely popular in recent weeks/months, but is the Copper market being run over by a bus full of tourists or by an actual increase in the demand in the global economy? All roads lead to Shanghai!

0 Comments