EM Gold Rush: The pressure valve amid Asian FX debasement risks?

Welcome to this week’s edition of our EM-focused weekly editorial. This week, we’ve decided to look into the reemerging weakness in Asian FX, and how this corresponds with the still strong momentum in gold prices.

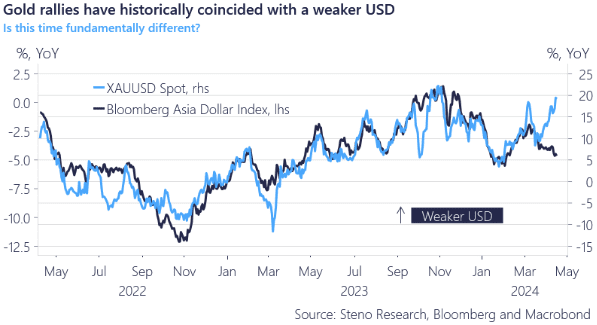

Gold rallies have historically coincided with a weaker USD. Recently however, the relation has flipped, as the two have performed in tandem – particularly against Asian FX which is generally trading on the back foot as it seems like the USDCNY fixing being lifted above 7.10 is seen as a major negative risk factor for markets.

Debasement risks in Asian currencies are still considered material, which in turn is good news for energy and precious metals as both work as release valves for the continued downside pressure.

Looking ahead to next week, we expect the US dollar to remain strong driven by rebalancing efforts from the real money sector. Same goes for the longer-run basis due to support from wider USD-EUR (or USD-CNY) inflation spreads.

Chart 1: Inverse USD / Gold has been distorted

Asian FX weakness is back, and the USD/Gold correlation has turned positive. This begs the question: How does it rhyme with the continued surge higher in gold, and has something fundamentally changed?

0 Comments