EM Cycle Watch: South Korea a good buy?

The latest Nvidia earnings report was testament to the demand for tech and particularly semis, and it proved the persistent strength of the AI theme. Demand for semis is currently outpacing production, and we consequently see declines in inventory (chart 1.b).

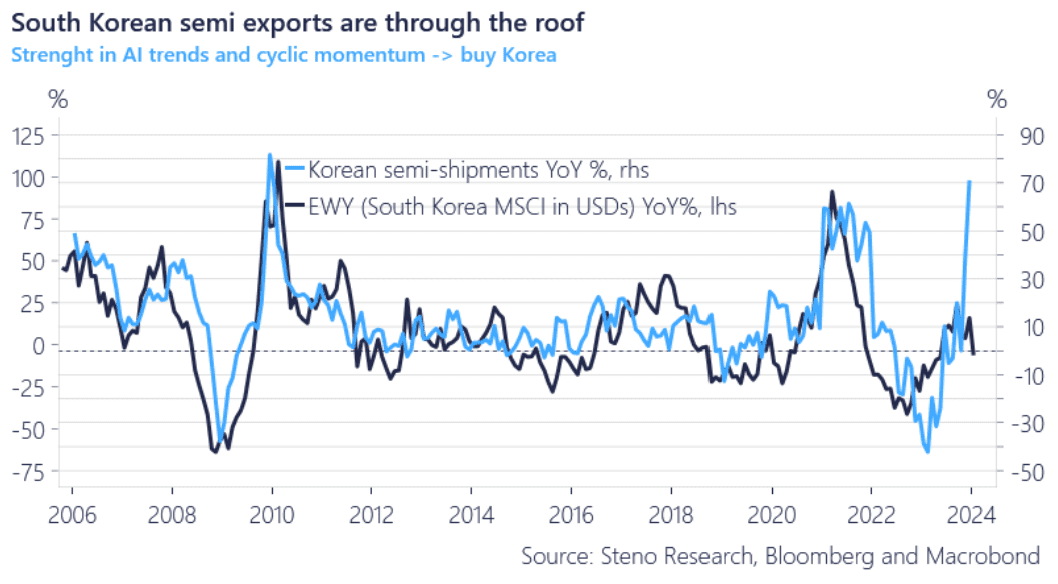

Charting the yearly change in South Korean exports of semis looks almost as ridiculous, but, interestingly, equities haven’t followed as the correlation would suggest – in fact the EWY index is flat YoY (chart 1.a).

Most of our indicators point to another (modest) cyclical impulse, and from a technical perspective, the Kospi looks decent. The below gap alone thus doesn’t make us reject Korean equities as much as it is indicative of decent room to enter.

Chart 1.a: Insatiable appetite for semis due to AI

Amidst some EARLY resurgence in China and signs of cyclical rebound, South Korea looks increasingly compelling. Could this convergence of factors signal a strategic entry point into South Korea’s manufacturing and AI-focused market?

0 Comments