EM by EM #35: China 2024: Keeping the beast alive

EM passive investors and other traders are betting on a rally from the great USD disinflation shift which has manifested itself lately in the OIS curve, so far unaccompanied by any expectations of a collapse in growth.

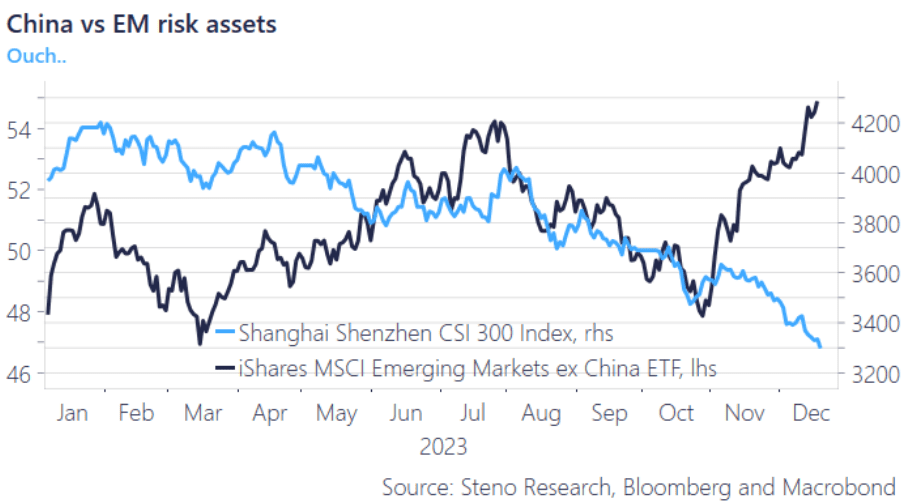

Unfortunately flows have been less rewarding for Chinese risk assets than EM peers- as the chart below implicitly implies, Q3 weakness was primarily driven by rates coinciding with the drawdown in US equities. Upside? Limited to USD sensitivity outside of China, or in other words- there is little favor left for China from allocators outside of the Mainland itself

Chart 1: China vs EM

Even though foreign investors are hesitant to take on more mainland risks, foreign banks seem to trust Chinese banks when it comes to credibility. They’re still willing to lend in USDs through swaps, despite the growing liabilities in …

Subscribe here to access the whole article

With investor sentiment through the floor in China, we take a look at the policy tool kit for 2024. Is China set for a rebound or will the sentiment remain stuck in the abyss?

0 Comments