EM by EM #29: Biden’s party, EM’s hangover & Scholz’s nightmare

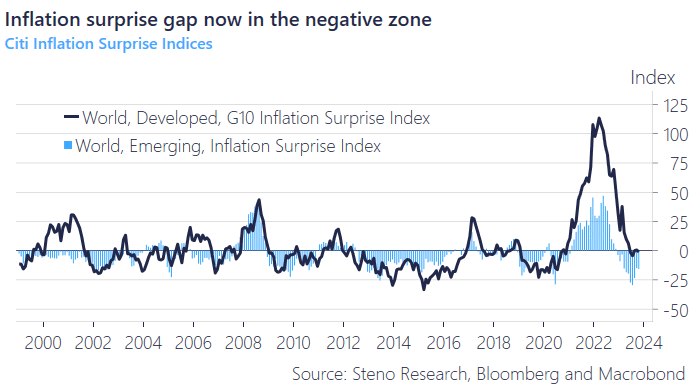

Here at Steno Research, our primary concern has been growth rather than inflation since around the end of H1. While this divergence is gradually gaining mainstream recognition, emerging markets have been well ahead of the curve. Consequently, disinflationary surprises continue to be prevalent.

The emerging market sphere is of course a diverse basket and there is a massive gap bet between the deflationary prints in China and the stubborn CPI prints in say Columbia that remain above 10% yoy but generally disinflation is surprising expectations-

The disinflationary message, especially in Europe, has undershot consensus but is increasingly aligned with market sentiment. Despite a few unfavorable developments in other regions (Aussie CPI stands out), markets are becoming increasingly concerned about the possibility of a recession rather than runaway inflation

Better late than never

Chart 1: Citi Inflation Surprises

The recent howler of 30y UST auction made yields spike and has served as a reality check for the brief optimism in emerging markets. But we refuese to concede to the negativity – We illustrate the long-term prospects for Latin America in the new deglobalized order below

0 Comments