Something for your Espresso: Yellen now decides the QT pace

Morning from Europe.

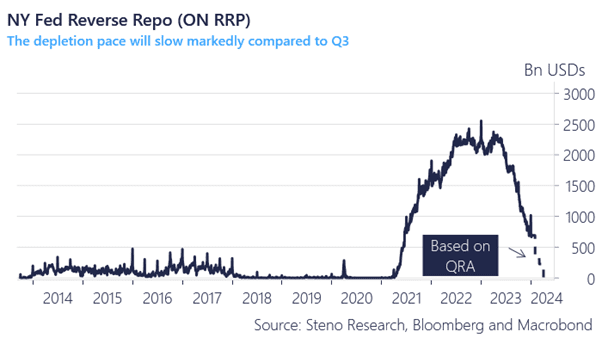

Tailwinds for equities are back after a needed positioning wash-out from the get go of the year. Liquidity is arriving in truckloads and the US Treasury is now behind the liquidity steering wheel after the Fed admitted to likely tapering QT once the ON RRP is close to depletion.

If/when Yellen net/net issues enough bills to tempt the remaining USDs out of the ON RRP facility, the Fed will take the decision to taper QT. The March meeting looks like a likely timing for such a decision and it has accordingly become a LOT harder to be negative on risk assets for 2024.

We will release a full study on how to trade the tapering of QT shortly after this morning report.

Chart 1: ON RRP to be depleted before the end of Q1

The liquidity tailwinds paired with fading Red Sea fears lead equities higher again. The mini positioning wash-out leaves a good entry-point for Q1 risk-on trade here.

0 Comments