Something for your Espresso: What is the status on this bank crisis?

Good morning,

It remains calm before the storm, if this liquidity/deposit crisis is truly turning into a credit crunch in the banking system.

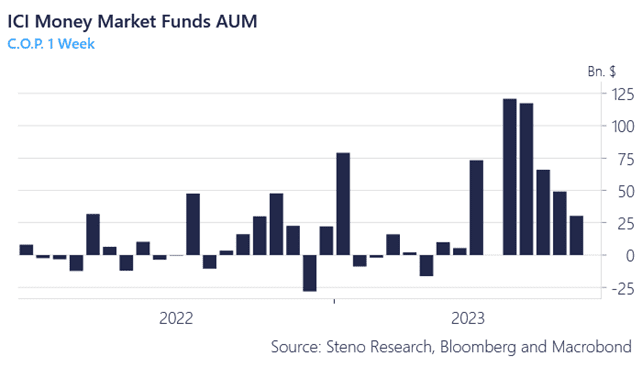

Money market funds inflows decreased to around 30bn over the past week, but it is not an overly big surprise since there is a scarcity of investable T-bills around due to the debt ceiling. The 1-month bill trades at implied rate levels below 4%, meaning that there is an overdemand of such a paper from players without access to the ON RRP, while the 2-month bill trades at implied rates of 4.6%.

The Money Market inflow will likely resurface once the debt ceiling deal is settled. Given that the “live” assessment of the Treasury General Account leads to a conclusion that less than $80bn are parked at the Fed, this issue of the debt ceiling may prove to be more imminent than thought by many including the Congressional Budget Office.

Chart 1: Money market inflows are slowing

Flows into money market funds are slowing, while only survey data truly hints of an upcoming credit crunch. Watch the H8 data on bank balance sheets end of business today.

0 Comments