Something for your Espresso: Wen recession?

The SLOOS Survey and the ISM index made for a hawkish reading (again) from the US economy.

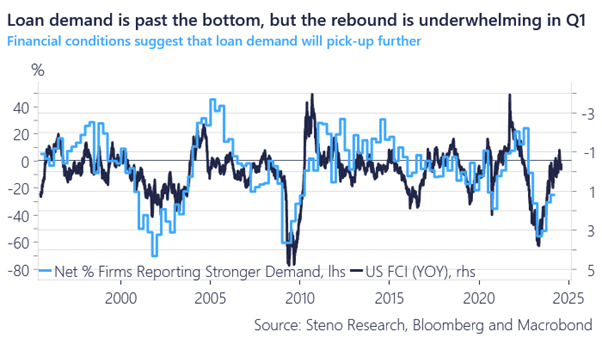

Both the demand and the supply side are picking up pace in the SLOOS survey, with credit standards getting back towards neutral territory after the easing of financial conditions.

The surveys, such as SLOOS, failed to accurately pinpoint economic trends in 2023, when they weakened. The question is whether the acceleration is a false flag as well? We doubt it given how well they rhyme with financial conditions.

Improving credit conditions and increasing lending growth is associated with a risk-on reflationary environment rather than the opposite.

Chart 1: Loan demand is picking up from weak levels

The US economy is accelerating, and various indicators have clearly bottomed out already. The question is if prices will accelerate alongside the rebound in activity and whether the rates market is still wrong.

0 Comments