Something for your Espresso: Waiting for the dust to settle..

Morning from Europe!

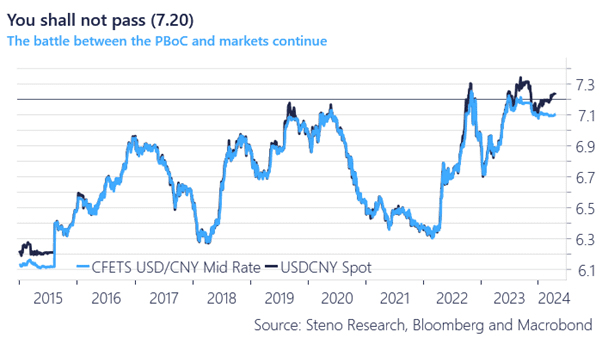

The USD is still in focus this week as USDCNY and USDJPY are trading around key levels. We speculated whether the PBoC and the Chinese authorities are preparing a managed devaluation in our editorial yesterday and we remain on high alert in USD vs Asian FX as a consequence.

In 2015, the PBoC conducted a managed devaluation of the CNY to align the spot market to a larger extent with the fixing in an attempt to regain control. I spent the weekend pondering whether the move above 7.10 in the CFETS fixing last week could be seen as a “trial balloon” and I am getting increasingly convinced that something is cooking, especially given the current stockpiling of natural resources that is ongoing.

Read our editorial on the risk of imminent FX action in Asia here.

Chart 1: Is the PBoC preparing a devaluation?

The embedded value in risk assets is improving, but the USD wrecking ball will continue into this week. The question is whether we have imminent action ahead from the BoJ/MoF or the PBoC as a consequence.

0 Comments