Something for your Espresso: Things you do not see during a disinflationary slowdown

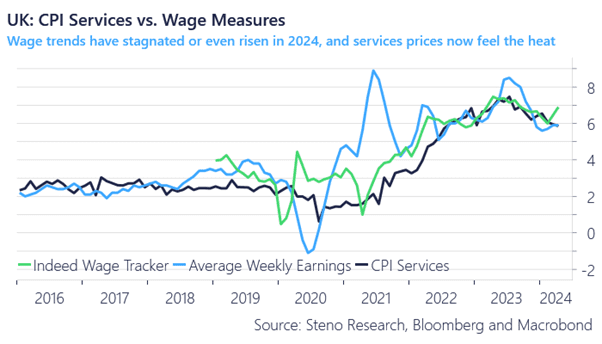

We typically observe a clear link between a weaker economic cycle, rising claims and unemployment, and a disinflationary process in service prices. However, this cycle appears to be out of the ordinary in many ways, as exemplified by the UK labour market report this morning.

The UK jobs data presents a mixed bag of factors, likely influenced by a changing sample due to lay-offs. Rising weekly earnings are once again paired with very weak employment trends and the highest monthly claims since the early stages of the pandemic.

This scenario looks stagflationary in many respects. We’ll have to see how markets react, but it does challenge our hawkish GBP rates view to some extent.

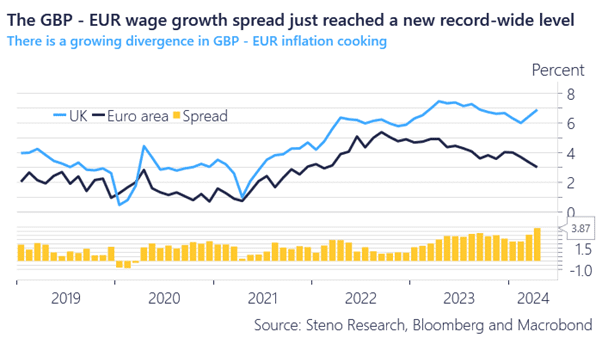

The spread between UK and Eurozone wage trends is massive and widening. The UK services CPI, which is heavily influenced by wage trends, challenges the hope for benign developments in service prices during the summer and the second half of the year for the Bank of England.

The BoE will need to devise new, creative de facto inflation targets after its recent shift to focusing on 3-month/3-month services CPI proved inadequate early in 2024. This focus will not fit the narrative for them in the coming months.

Chart 1a: UK service CPI likely to see upside pressures from wages again

Chart 1b: The spread between UK and EU trends in wages is massive and widening

If we are indeed experiencing a slowdown, it is not the typical one characterized by clear disinflation. The job report from the UK this morning reminds us that this is not an ordinary disinflationary slowdown.

0 Comments