Something for your Espresso: The USD was killed alongside the CPI

Good morning!

The last cherry on the cake is here this Friday morning. We are covering a lot of ground here while everyone is off to the beach and this morning we got 4 bullet points on the morning menu to go:

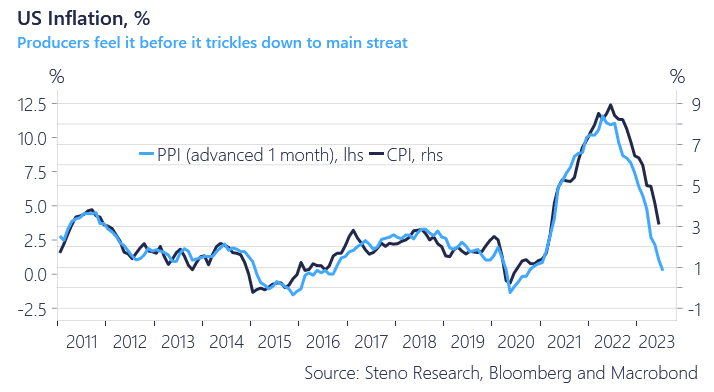

This week saw dovish prints in both CPI and PPI. If you haven’t done it yet, check out our thoughts on the CPI print from Wednesday here. With regards to PPI, yesterday’s downward surprise continues to hint at headline inflation at around 1%. Lots of caveats in this one, one being the fading base effects from last summer and on a MoM level, this month’s rally in energy should also show up. However, all in all, we still remain confident that we are within the 2% handle by the end of the year.

The positioning squeeze in the long USD bet and in Oil-shorts is interesting as it seems driven by the CPI/PPI dovishness paired more than the Saudi Arabian supply hawkishness.

Chart 1: US CPI is DONE

If the USD got killed because of the CPI, the USD bulls will return with a vengeance once it gets increasingly clear that the CPI is getting killed in Europe, Australia and elsewhere within a few months from here, but something more structural might be brewing beneath the surface?

0 Comments