Something for your Espresso: The party is still ongoing!

Morning from Europe.

Nvidia delivered as we hoped for, and yet again expectations for the AI-wave were not exponential enough. Earnings beat both expectations both on top- and bottom line, underlining the strength in the AI theme – and markets are celebrating accordingly.

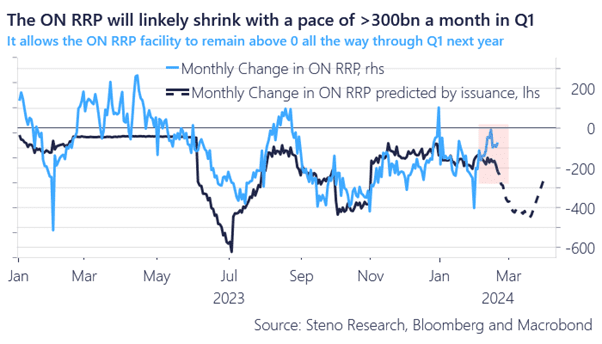

The FOMC meeting minutes from January also underpin the momentum in equity duration assets as the minutes were 1) relatively firm on “high for longer” if inflation progress stalls as has been the case and 2) firm on QT tapering being appropriate soon both due to operational reasonings and considerations related to the depletion of the ON RRP.

Bottom-line: The first rate cut is not close, but the QT tapering will most likely happen in March, which makes for a benign USD liquidity outlook.

This is the key quote from the FOMC minutes:

“In light of ongoing reductions in usage of the ON RRP facility, many participants suggested that it would be appropriate to begin in-depth discussions of balance sheet issues at the Committee’s next meeting to guide an eventual decision to slow the pace of runoff.”

Chart 1: ON RRP depletion has stalled a bit in February but looks on track for quarter-end

Big tech keeps surprising on the upside despite heightened expectations, while the Fed is moving closer to a tapering of QT. This makes for a benign scenario for the business cycle despite a lack of imminent rate cuts.

0 Comments