Something for your Espresso: The inflation target is coming into sight

Morning from Europe.

The BoJ comitee member Takata labelled the inflation target as “coming into sight” overnight, which has led to a strong move in JPY in anticipation of action from the BoJ during the early spring.

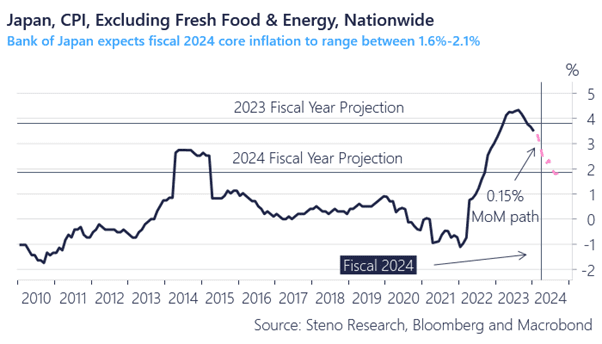

A trajectory of 0.15% MoM or below in core inflation is needed to dovishly surprise BoJ forecasts into 2024. In seasonally adjusted terms, we are still running slightly above such levels leaving an April hike out of NIRP territory very likely.

The question is whether the BoJ is able to control the market sentiment if they make the first move on front-end rates as markets tend to extrapolate such trends into eternity.

We accordingly like our short in CHFJPY still and see market chasing upside risks to the current market pricing of 10bp hikes in April, October and January (2025).

Chart 1a: Inflation path in Japan versus the projections from the BoJ for 2024

Takata from the BoJ has truly restarted speculations in action from the BoJ already in April as he labeled the inflation target as “coming into sight”. Meanwhile, the EUR-flation target may be coming into sight from the other direction despite lukewarm releases today.

0 Comments