Something for your Espresso: The confusing flexibility of the BoJ

Goodmorning from Europe.

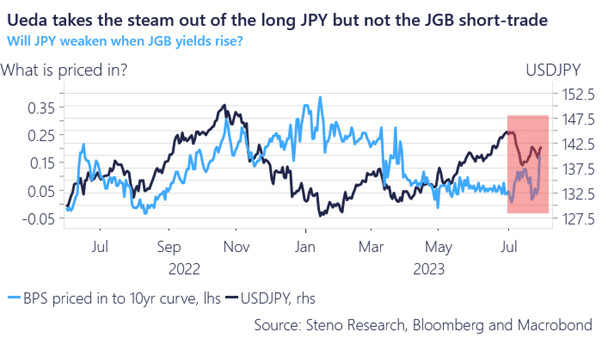

An interesting market cocktail during the early hours of this week’s trading with 1) a much weaker JPY, 2) higher JGB yields paired with curve steepening and 3) Strong JPY based equity performance.

Maybe this was the exact cocktail of market trends the BoJ attempted to orchestrate with the ambiguity around the flexibility introduced to the YCC program?

The decreased automatic procyclicality in the balance sheet policy is 1) good news for the downside protection of Japanese equities (as the BoJ will now buy more on the downside than on the topside), 2) Good news for financials and 3) bad news for the JPY.

This could be seen as a blessing in disguise for Chinese equities as well as we also see early signs of this morning.

Chart 1: A weaker JPY and higher JGB yields on the cards?

A weaker JPY paired with higher JGB yields and a steeper curve. The JPY markets are sending mixed signals but maybe the whole purpose of the BoJ policy was to leave markets uncertain on the direction of travel.

0 Comments