Something for your Espresso: Saudi Arabians losing the battle?

Ueda has spiced up the December BoJ meeting over the past 24 hours commenting that he has no “specific level in mind” when raising rates, which could be seen as a growing optimism of the ability to deliver more than one rate hike this cycle. Given how the global commodity markets behave, we’d argue that the timing could prove to be extremely bad, which is reminiscent of the 2007 playbook (again).

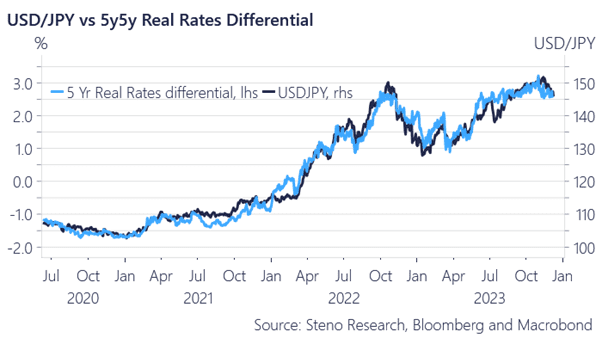

Real Rates differentials continue to lead the development for USDJPY and after the weak 30yr auction, spreads have moved in favour of the JPY again, but we will likely see spill-overs to most Western bond markets as well.

We have not found strong rhetorical evidence of the Japanese rate hike timing being the “calendar year end”, but have so far leaned on an assumption of a timing ahead of the “fiscal year end” in late Q1. That is now a debatable assumption.

Chart 1: USDJPY versus real rates

The bearish price action continues in oil, while the BoJ meeting in December is suddenly seen as “live” by market participants. Can BoJ move the needle before year-end?

0 Comments