Something for your Espresso: Phew..

Morning from Europe

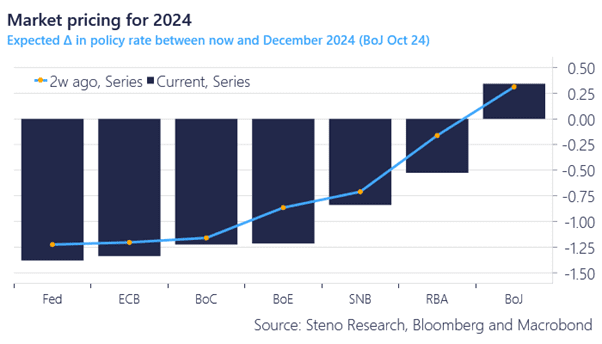

Fed is back as the biggest dove in town after delivering (with quite some distance) the most dovish message to markets.

We are still puzzled as 1) financial conditions are much easier in the US than in the Euro-zone or UK, 2) The US economy is doing better than peers and 3) Inflation momentum is worse in the US than across the pond.

Maybe next week’s inflation report from the UK will lead to a material repricing of the BoE outlook relative to the Fed? We keep our chips placed on a very soft UK inflation reading on Tuesday.

Furthermore, the RBA pricing now looks oddly out of whack with the rest of G10 and we ponder adding exposure in AUD duration consequently. More about that later today!

Chart 1: Fed is the biggest dove in town now

A big central bank week is approaching its end and the Fed is back as the biggest dove in town. Does it make sense? Meanwhile, Oil demand dynamics keep delivering.

0 Comments